CVC Overview

Established in 1981, CVC is a leading global private markets manager with expertise in private equity, secondaries, credit, and infrastructure.

We price corporate risk and build better businesses through:

- The CVC Network of specialised sector and geographic teams, with 16 European offices and 30 globally, providing a strong pipeline of investment opportunities.

- A deep bench of long-tenured investment professionals applying a proven underwriting and value creation process shaped over 40 years.

- A consistent track record of robust performance across strategies.

CVC Private Wealth brings this expertise to eligible investors, supporting them to diversify, preserve and grow their wealth.

Track Record

years

history of generating returns for our investors

CVC Network

global offices

investing for seven complementary strategies

One Team

investment professionals

embedded in their local markets

Scaled Platform

Assets under Management

supported by loyal investment base

Why private markets

Private markets offer investors more comprehensive access to the global economy than public markets.

Investment opportunities range from early-stage growth companies, to direct lending that provides flexible financing to businesses, through to large-scale infrastructure projects that support national development.

Once considered as alternative, private markets have become a core pillar of modern portfolios, shaped by shifting market dynamics and growing investor demand.

An allocation to private markets could offer a range of opportunities to eligible individuals, including:

- Potential for Higher Risk-Adjusted Returns

- Greater Portfolio Diversification

- Reduced Correlation to Public Markets

|

|

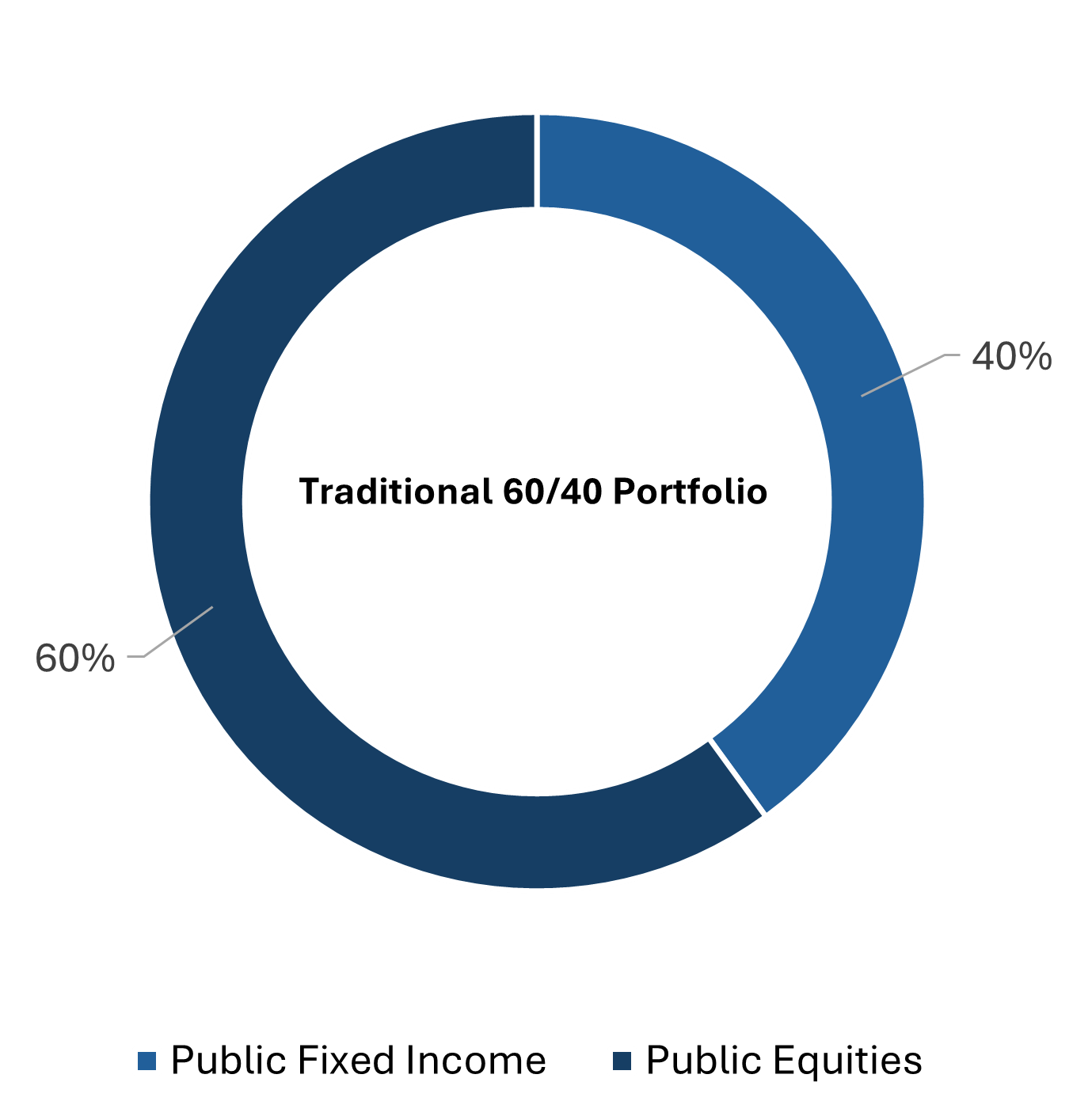

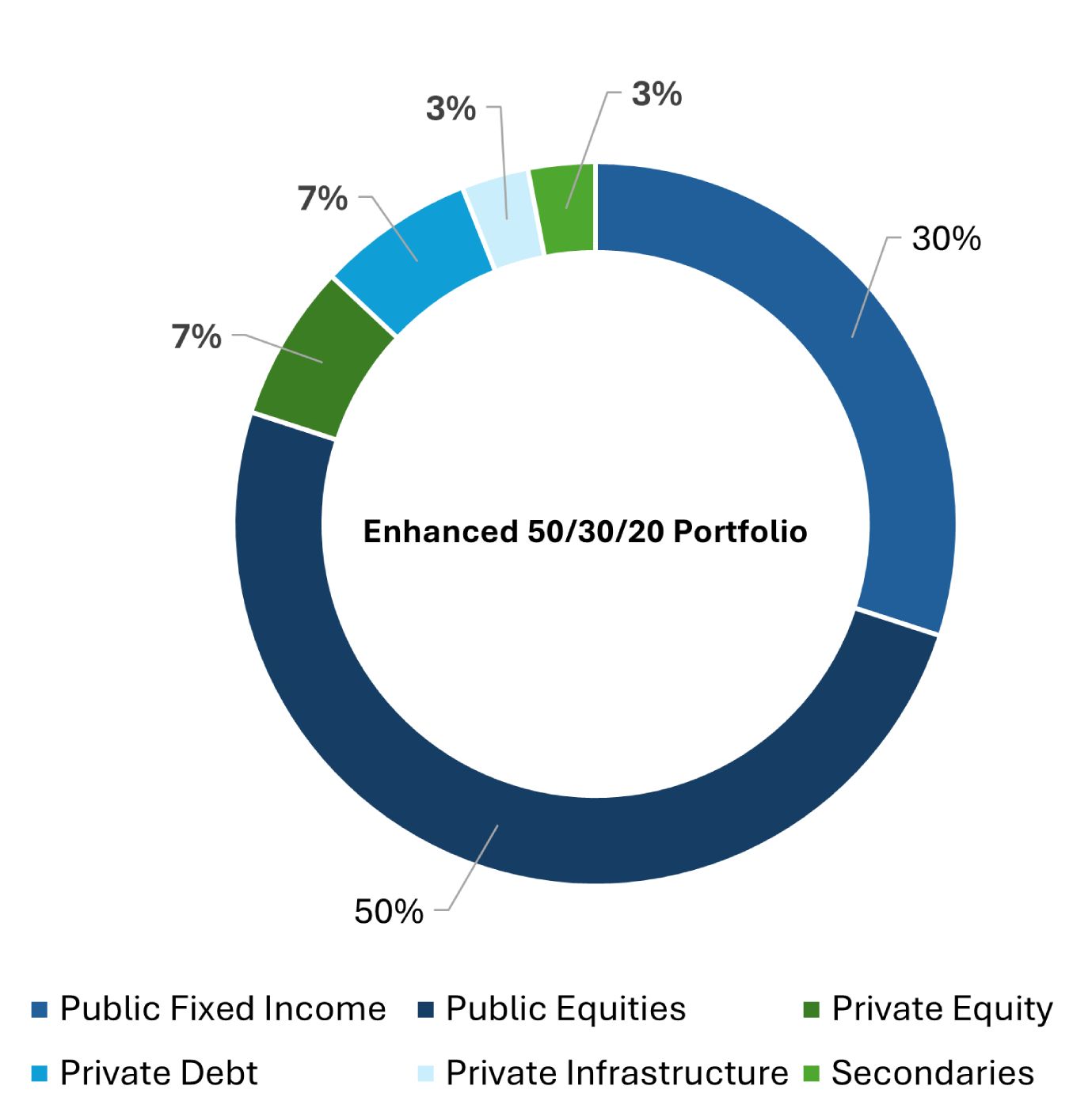

| 60/40 Portfolio | Enhanced with Private Markets | |

| Annualised Returns | 6.0% | 7.2% |

| Annualised Volatility | 11.3% | 10.5% |

| Sharpe Ratio | 0.54 | 0.69 |

Source: MSCI/Burgiss, Bloomberg, CVC. Data from June 2005 to March 2025. Global Public Equities derived from MSCI ACWI US, Public Fixed Income derived from Bloomberg Global Aggregate Total Return Unhedged US. Private Equity, Private Credit, Private Infrastructure and Secondaries all derived from MSCI Burgiss. Public portfolios rebalanced on a quarterly basis. For illustrative purposes. Past performance is no guide to future performance.

CVC’s Private Wealth Products

CVC’s private wealth products give eligible investors the opportunity to invest alongside CVC’s institutional-quality strategies through a single investment.

They also offer the added flexibility of evergreen structures, with periodic liquidity windows, compounding growth from day one, continuous deployment, and the ability to optimise target allocations.

Guided by CVC’s global but local network and proven investment process across multiple economic cycles, our private wealth products are designed to build better businesses and support long-term wealth creation.

Private Equity

CVC-PE is an open-ended, private equity investment vehicle investing directly into companies and other private assets alongside CVC’s private equity funds.

Read more

Credit

CVC-CRED is an open-ended, private credit investment vehicle for income-focused investors, managed by CVC Credit.

Read moreInsights

Disclaimer

Nothing in this publication constitutes a valuation or investment judgment regarding any specific financial instrument, issuer, security, or sector mentioned or referenced herein. The content presented does not represent a formal or official view of CVC and is not intended to relate specifically to any investment strategy, vehicle, or product offered by CVC. This publication is provided solely for informational purposes and is intended to serve as a conceptual framework to support investors in conducting their own analysis and forming their own views on the subject matter discussed. No assurance can be given that any investment strategy discussed will be successful. Past market trends are not reliable indicators of future performance, and actual outcomes may vary significantly. The information, including any commentary on financial markets, is based on current market conditions, which are subject to change and may be superseded by subsequent events.

THIS CONFIDENTIAL DOCUMENT IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION AND MAY NOT BE USED FOR AND DOES NOT CONSTITUTE AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO SUBSCRIBE FOR OR PURCHASE ANY INTERESTS OR TO ENGAGE IN ANY OTHER TRANSACTION. Nothing contained herein shall be deemed to be binding against, or to create any obligations or commitment on the part of, the addressee nor any of CVC Capital Partners plc, Clear Vision Capital Fund SICAV-FIS S.A, each of their respective successors or assigns and any form of entity which is controlled by, or under common control with CVC Capital Partners plc or Clear Vision Capital Fund SICAV-FIS S.A. (from time to time the “CVC Entities“ or “CVC” and each a “CVC Entity”). For the purpose of the foregoing definitions, control includes the power to (directly or indirectly and whether alone or with others) appoint or remove a majority of an entity’s directors or its general partner, manager, adviser, trustee, founder, guardian, beneficiary or other management officeholder) and controlled and controlling shall be interpreted accordingly. No CVC Entity undertakes to provide the addressee with access to any additional information or to update this Confidential Document or to correct any inaccuracies herein which may become apparent.

Certain information contained herein (including certain forward-looking statements, financial, economic and market information) has been obtained from a number of published and non-published sources prepared by other parties and companies, which may not have been verified and in certain cases has not been updated through the date hereof. While such information from other parties and companies is believed to be reliable for the purpose used herein, no member of CVC, any of their respective affiliates or any of their respective directors, officers, employees, members, partners or shareholders assumes any responsibility for the accuracy or completeness of such information. Certain economic, financial, market and other data and statistics produced by governmental agencies or other sources set forth herein or upon which the CVC’ analysis and decisions rely may prove inaccurate.

Nothing contained herein shall constitute any assurance, representation or warranty and no responsibility or liability is accepted by CVC or its affiliates as to the accuracy or completeness of any information supplied herein or any assumptions on which such information is based. Further, this Confidential Document reflects only the views of CVC with respect to private equity markets and other market participants may hold different views or opinions. Accordingly, each Recipient should conduct their own independent due diligence and not rely on any statement or opinion offered herein.

In addition, no responsibility or liability or duty of care is or will be accepted by CVC or its respective affiliates, advisers, directors, employees or agents for updating this Confidential Document (or any additional information), or providing any additional information to you. Accordingly, to the fullest extent possible and subject to applicable law, none of CVC or its affiliates and their respective shareholders, advisers, agents, directors, officers, partners, members and employees shall be liable (save in the case of fraud) for any loss (whether direct, indirect or consequential), damage, cost or expense suffered or incurred by any person as a result of relying on any statement in, or omission from, this Confidential Document.