The Evergreen Series

Why Europe Offers a Strategic Private Equity Advantage

Private equity opportunities extend well beyond the United States. Europe’s $20 trillion+ economy1 and over 500 million consumers2, support the world’s second-largest buyout market.

For investors, Europe offers scale, depth and access to a distinctive pipeline of opportunities, with more than 12,000 companies3 generating over $300 million in annual revenue.

This breadth makes the region particularly attractive for portfolio diversification and long-term growth potential.

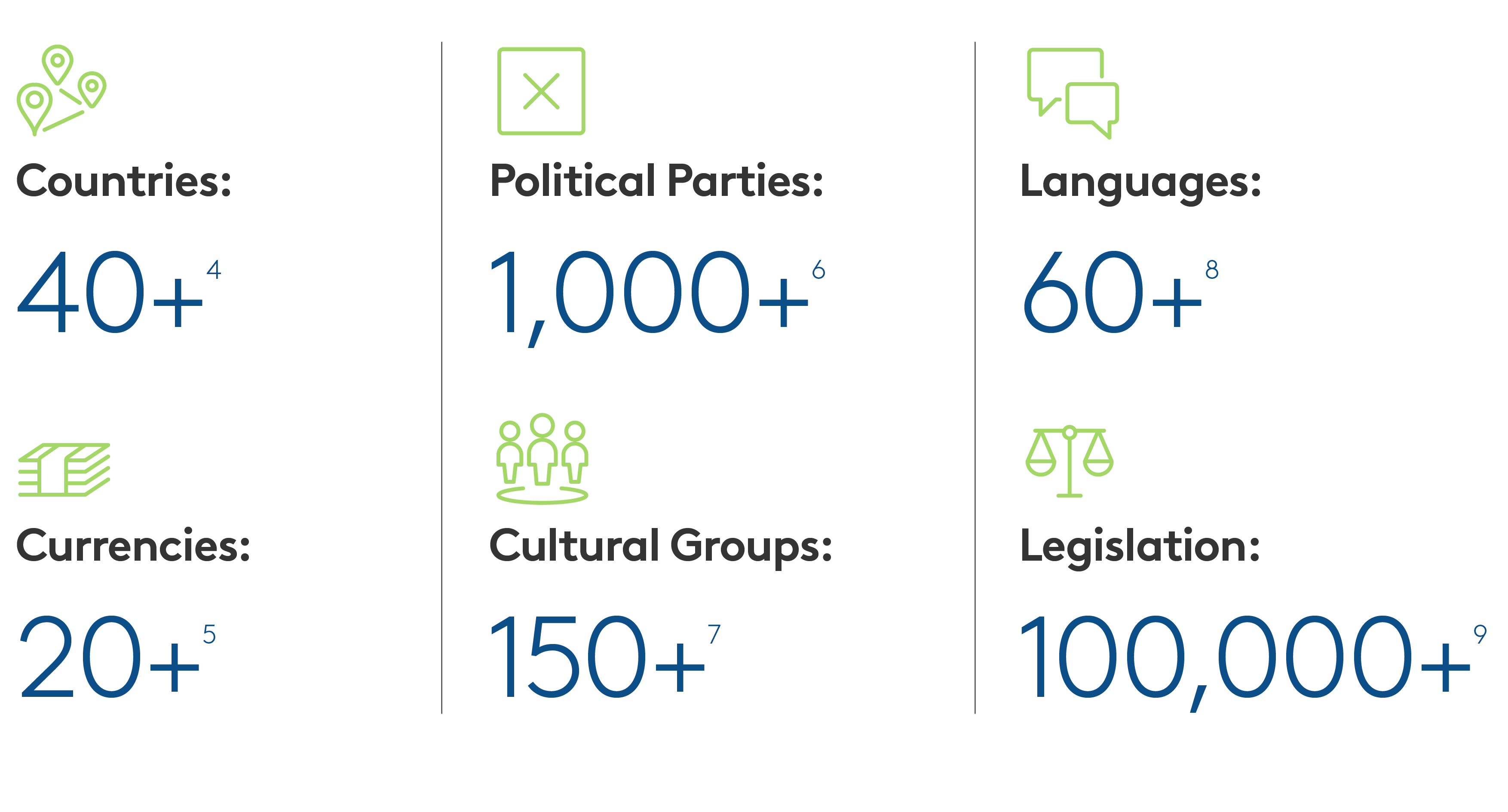

Europe’s Fragmentation: A Competitive Advantage in Disguise

Europe’s fragmented geography, regulatory landscape, languages, political structures and cultures are complex.

However, for experienced local managers, fragmentation becomes a competitive edge, not a barrier.

It offers access to a less crowded market with high-quality, often undervalued assets.

Fragmentation creates inefficiencies that, with the right local manager, can be harnessed to drive outperformance through strategies grounded in local market dynamics.

European Buyouts: Lower Valuations, Strong Returns

European buyouts typically trend at lower valuation multiples than those in the U.S.

This is driven by the European market typically operating on a more local, bilateral, and less competitive basis.

In contrast, the more mature U.S. private equity market has a larger number of buyers and higher deal competition, which diminishes the advantage of local expertise.

Source: Pitchbook 2024. This information is included solely for illustrative purposes. Past returns are no guarantee for future returns.

As the chart below shows, European buyouts have delivered performance comparable, if not better, than the U.S. over a long-term horizon.

This highlights the strength and resilience of the European private equity market, which has shown an ability to deliver compelling returns across different market environments.

Source: Cambridge Associates as of March 2025. Note: Data for U.S. and Asia-Pacific calculated in U.S. dollars; data for Europe calculated in Euros; Europe includes developed economies only. Data for U.S. and Developed Europe is for buyout funds, data for Asia-Pacific is for buyout and growth funds. This information is included solely for illustrative purposes and should not be relied upon for any other purpose. Past returns are no guarantee for future returns.

Return Dispersion in Europe: Why Manager Selection Is Key

Return dispersion in private equity is wide, and Europe's fragmented market only amplifies it.

Source: Pitchbook, 2024.

Success therefore hinges on appointing a manager with deep local networks, the kind that unlocks proprietary deal flow beyond the reach of most competitors.

This edge must be combined with rigorous investment discipline to underwrite with conviction and the operational expertise to drive post-acquisition value creation.

In the right hands, Europe’s complexity is not a hurdle but a dependable source of outperformance.

1.Trading Economics : GDP - Countries - List | Europe

2.European Union Eurostat, UK Office for National Statistics: [tps00001] Population on 1 January and Population estimates for the UK, England, Wales, Scotland and Northern Ireland - Office for National Statistics

3.S&P Capital IQ 2025

4.Countries: List of countries in Europe - The World Countries

5.Currencies: List of Europe Currencies By Countries

6.Political Parties: Parties and Elections in Europe

7.Cultural Groups: Europe - Trade, Manufacturing, Services | Britannica

8.Languages: Languages in Europe - Globe Language

9.Legislation: Find legislation | European Union