Why European Private Credit Belongs In Your Portfolio

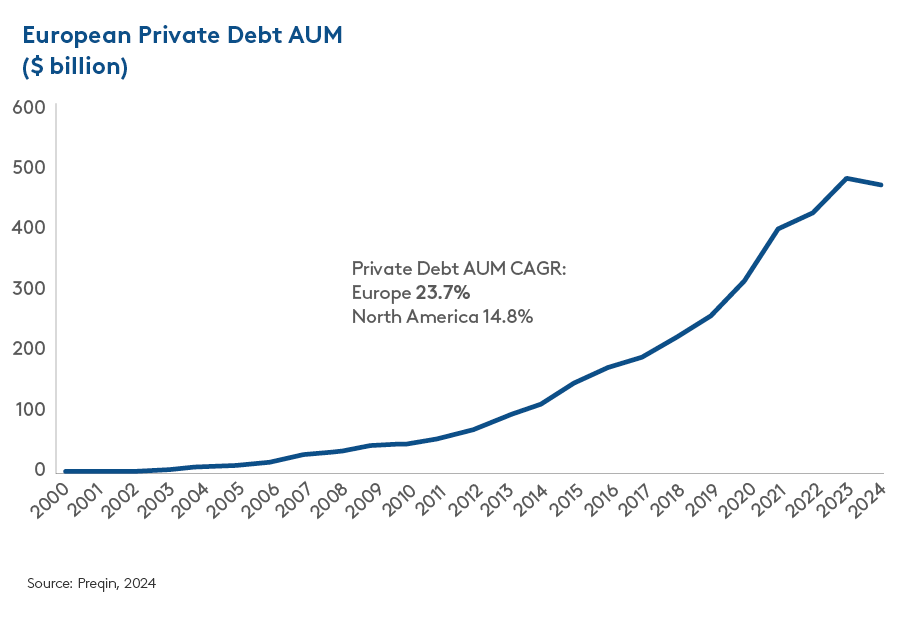

Private credit has grown from an “alternative” to a core global market exceeding $2.5 trillion1.

Following the Global Financial Crisis (2008-2009), tighter bank regulation left a lasting structural funding gap that private lenders continue to fill.

Periods of risk aversion, such as in 2022 to 2023, give private lenders another cyclical chance to provide capital when traditional liquidity recedes.

Today, allocation to private credit is no longer the question, geography is. Europe offers a compelling opportunity for long-term bespoke private lending.

Banks still supply roughly over 80%2 of corporate lending across the continent, however Basel III/IV rules are squeezing their capacity to provide credit3.

At the same time, European private credit assets sit at roughly $500 billion, versus the U.S. pool of $1.1 trillion, and are growing rapidly4.

As banks continue to retreat, the gap between shrinking supply and rising demand widens.

Direct lenders can bridge that gap with customisable financing solutions, giving them a long runway for growth.

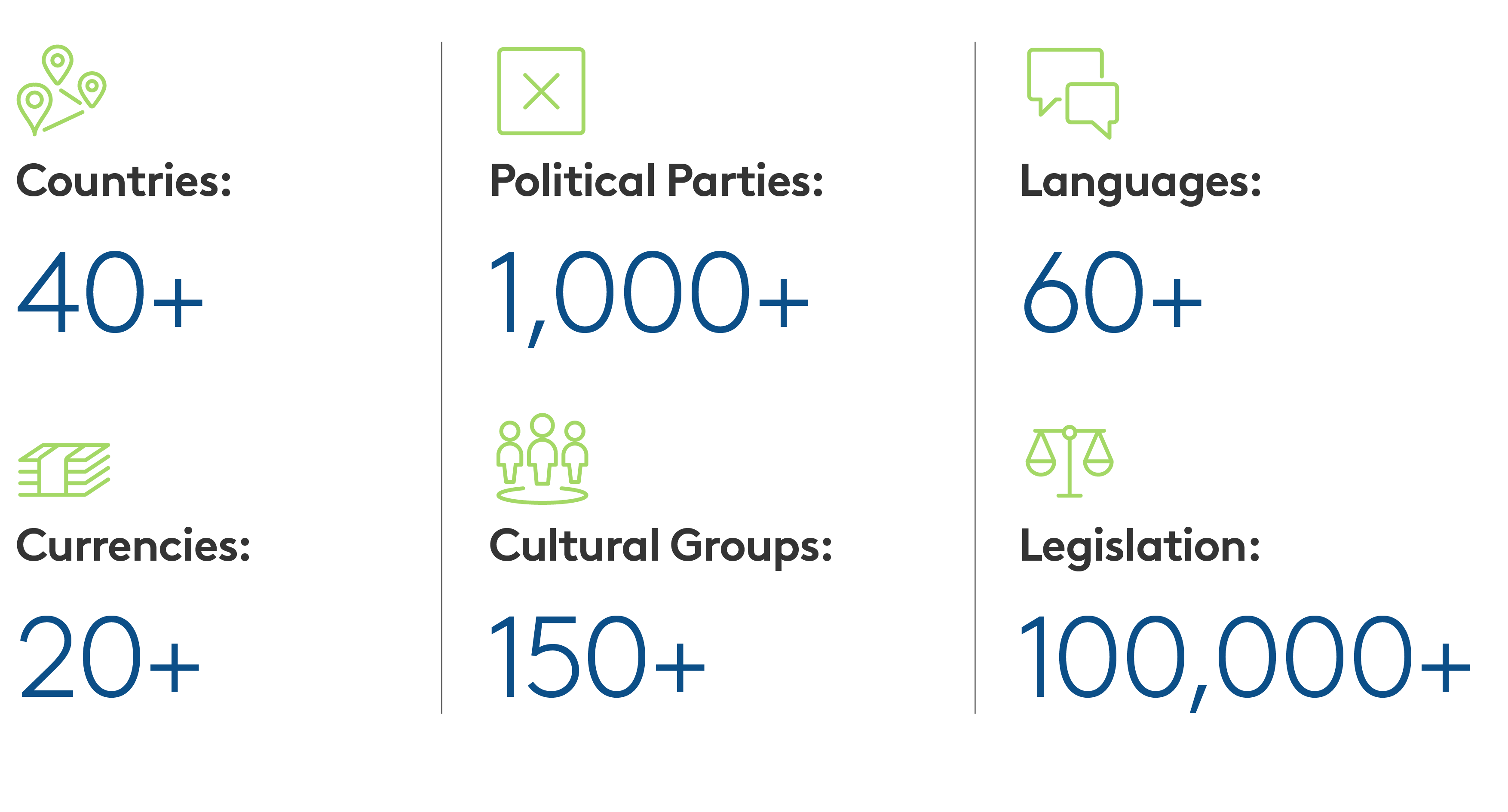

Such potential, however, is not on offer to every manager. Europe’s market fragmentation sets a higher entry bar, one that fewer managers can clear.

European Private Credit: Attractive Spreads & Downside Protection

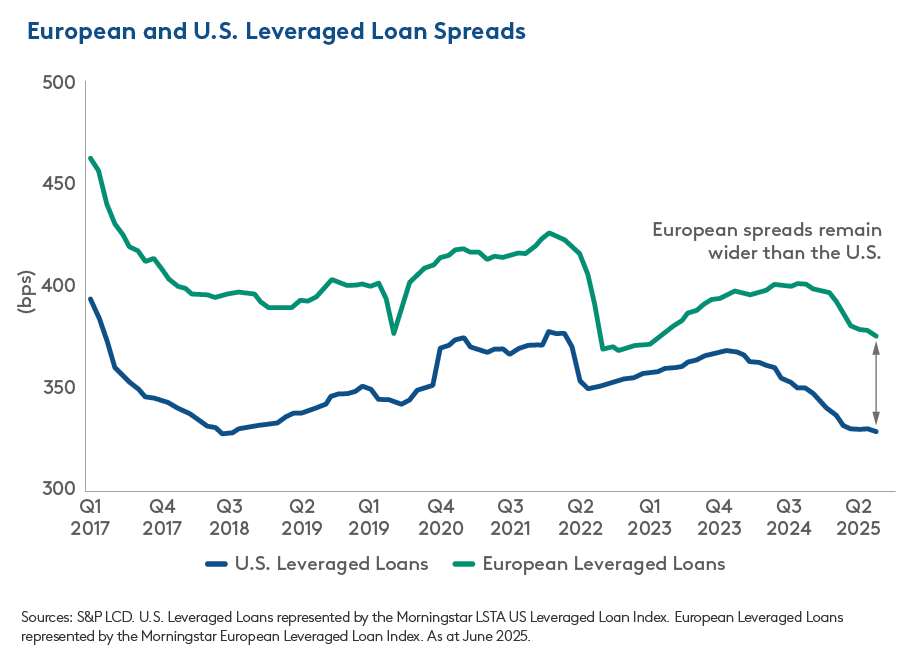

With fewer lenders with the right skillset and local networks operating in Europe than in the U.S., borrowers must pay more to secure financing.

This is evident in European loan spreads which have been about 50 basis points higher than comparable U.S. loans since 2017. This premium is expected to persist.

European fragmentation sustains this premium, offering investors durable yield pick-up.

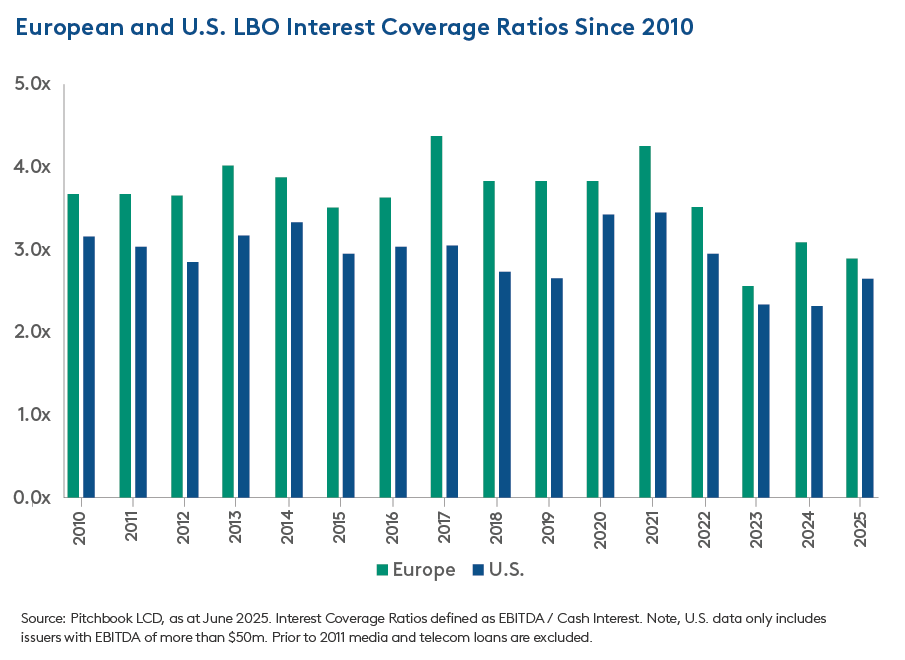

Importantly, that extra yield is not bought at the expense of weaker credit.

European leveraged buyout loans (LBO) have shown stronger interest coverage than those in the U.S. every year since 2010.

Conservative underwriting and lower leverage give borrowers more headroom to absorb volatility, enhancing downside protection.

For lenders, senior European loans sit at the top of the capital stack, pairing strong downside protection with attractive returns.

Additionally, European policy rates appear to have reached equilibrium, whereas U.S. rates are still moving and there is uncertainty where they will ultimately settle.

Europe’s Fragmentation: Europe’s Enduring Edge

Europe’s wider spreads are structural, not cyclical, and fragmentation is a major reason.

The region’s varied geographies, regulations and languages add complexity that narrows the pool of competing private lenders.

Meanwhile, mid-market borrowers rarely access public bond markets and instead rely on relationship lenders, leaving capital scarce and pricing power with local lenders.

Fragmentation turns into an advantage when investment managers combine deep local networks with extensive knowledge of Europe’s sectors, cultures, legal frameworks and documentation barriers.

This expertise delivers proprietary deal flow, firmer covenants and yield premiums other lenders may struggle to secure.

For private equity sponsors and their portfolio companies, the same local presence and knowledge deliver private credit structures that are highly customisable, executed quickly and provide reliable access to capital. Many sponsors leverage this market throughout the cycle.

By contrast, returns in U.S. private credit are increasingly commoditised by scale and covenant-lite structures, with excess capital supply from Business Development Companies.

Harnessing Europe’s fragmentation for tighter terms and richer spreads makes investment skill and local presence, not size alone, a durable, repeatable edge.

Manager Selection Is Decisive

Europe’s private credit landscape offers an appealing blend of structural yield premia, tighter covenants and generally lower leverage.

However, not all managers have the platform to capitalise on Europe’s fragmentation, making manager selection even more important.

To fully benefit from the European advantage, success rests on choosing a manager who can:

- Originate proprietary deal flow through deep local relationships, easing competitive pressure on terms and pricing.

- Apply a proven credit analysis framework, harnessing country and sector specific insight, to set prudent leverage and drive resilient covenants.

- Execute disciplined post-investment monitoring to safeguard capital when cycles turn.

In the right hands, Europe’s fragmentation is not a hurdle, but potentially a reliable source of yield premium over comparable U.S. loans.

1 The global drivers of private credit

2 Structural shifts in Europe’s credit ecosystem | UBS Global

3 Basel IV set to benefit private credit - Alternative Credit Investor

4 Preqin 2024.

5 Countries: List of countries in Europe - The World Countries

6 Currencies: List of Europe Currencies By Countries

7 Political Parties: Parties and Elections in Europe

8 Cultural Groups: Europe - Trade, Manufacturing, Services | Britannica

9 Languages: Languages in Europe - Globe Language

10 Legislation: Find legislation | European Union