CVC Private Wealth - 2026 Private Equity and Credit Outlook

Resilience, Opportunity and a Strengthening European Advantage

Quick Recap:

In 2025, markets advanced overall, however the investor experience did not always feel straightforward.

Headlines were dominated by tariff developments, geopolitical tensions and elevated volatility, with average market volatility reaching its highest level since 20221. Early-year uncertainty weighed on sentiment and briefly slowed deal activity.

Beneath this surface noise, however, the real economy showed signs of underlying strength. Inflation moderated, labour markets remained relatively firm and central bank policy became more accommodative, easing financing conditions.

In Europe, supportive fiscal policy further contributed to economic momentum, while interest in private capital continued to develop across both equity and credit strategies.

As the year progressed, early caution gave way to greater confidence, and 2025 ultimately became defined by one clear theme: resilience.

Looking ahead to 2026, these dynamics provide a more constructive backdrop for European private markets, even as geopolitical volatility is likely to remain a persistent feature of the environment.

In this setting, selectivity remains paramount, with Europe offering diversification benefits, relative value and sound underlying fundamentals for long term investors.

Private Equity 2026 Outlook

Global deal activity is expected to improve, although geopolitical volatility is likely to persist. In this environment, selectivity remains essential, with Europe offering meaningful diversification benefits.

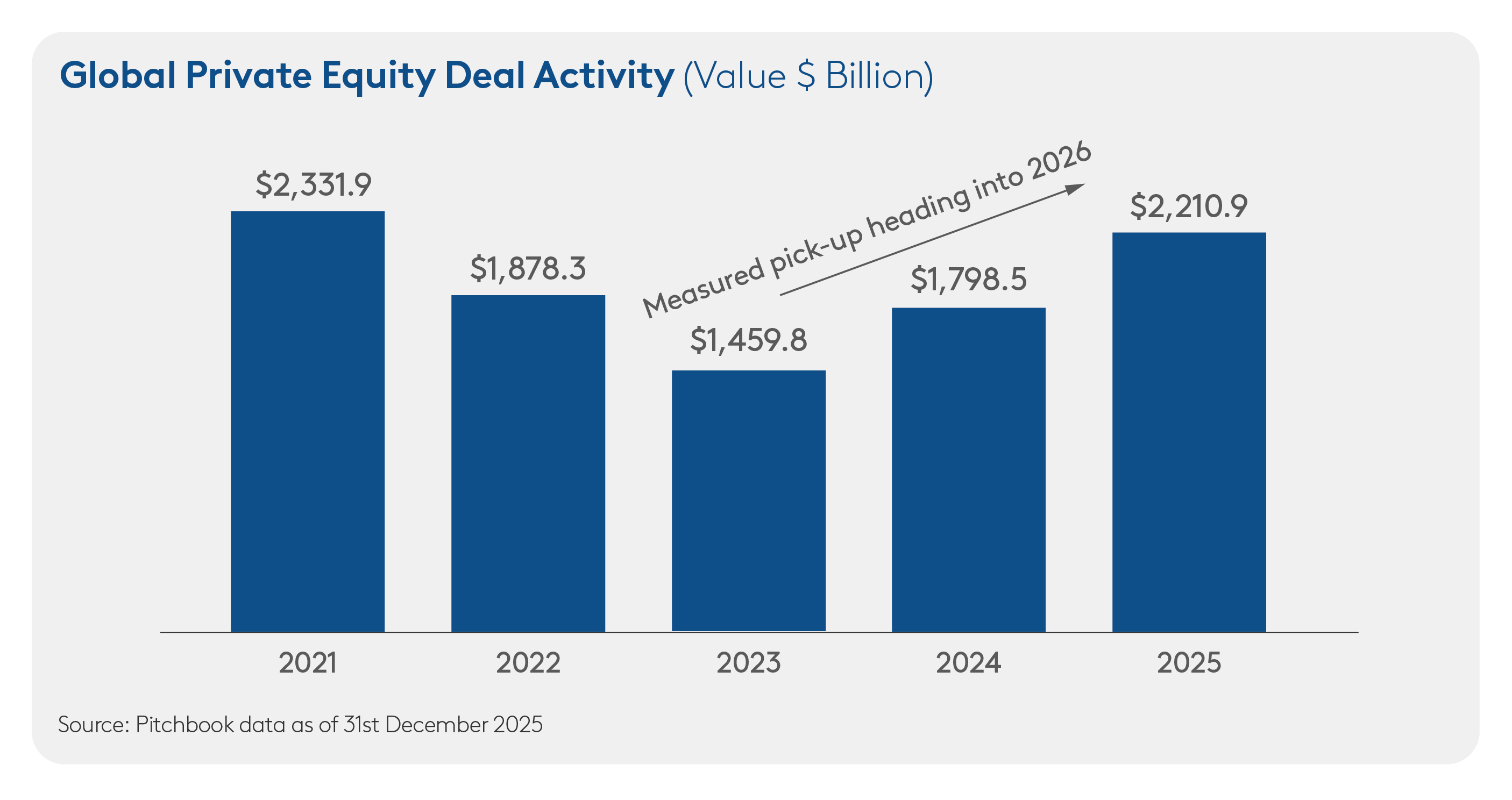

Deal Activity: A Measured Global Pick-Up

- Global deal activity strengthened in the second half of 2025 as financing conditions improved and confidence returned, with Europe performing particularly well.

- This momentum is expected to carry into 2026, albeit at a measured pace and against a backdrop of ongoing geopolitical volatility.

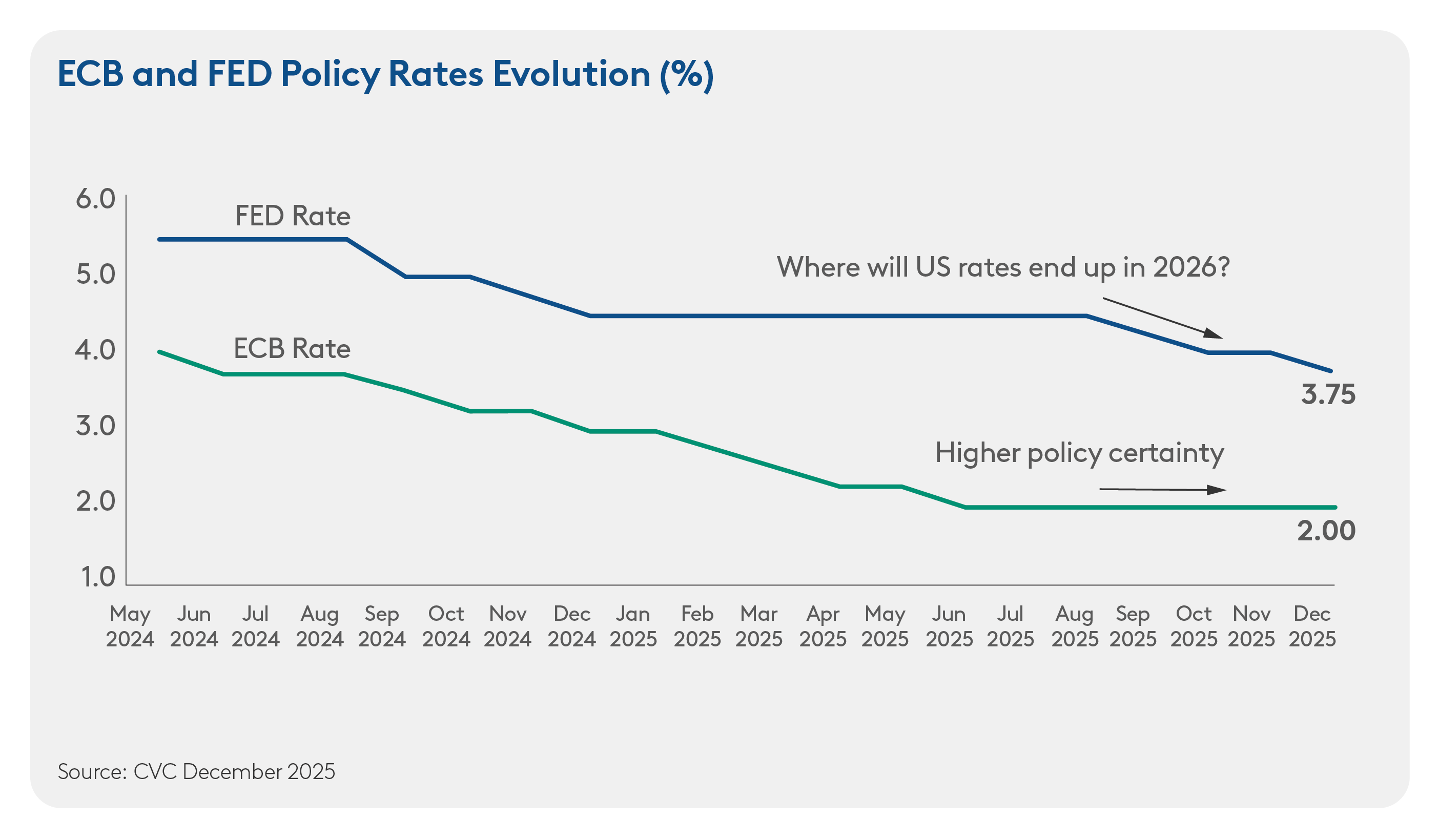

- Financing visibility is improving as rate paths stabilise across central banks. In Europe, ECB policy rates appear to have reached equilibrium and remain below those of the Fed, supporting transaction viability.

- In parallel, structural initiatives aimed at reindustrialisation, energy transition and strategic autonomy are reinforcing growth prospects, generating incremental demand for private capital and specialist investment expertise.

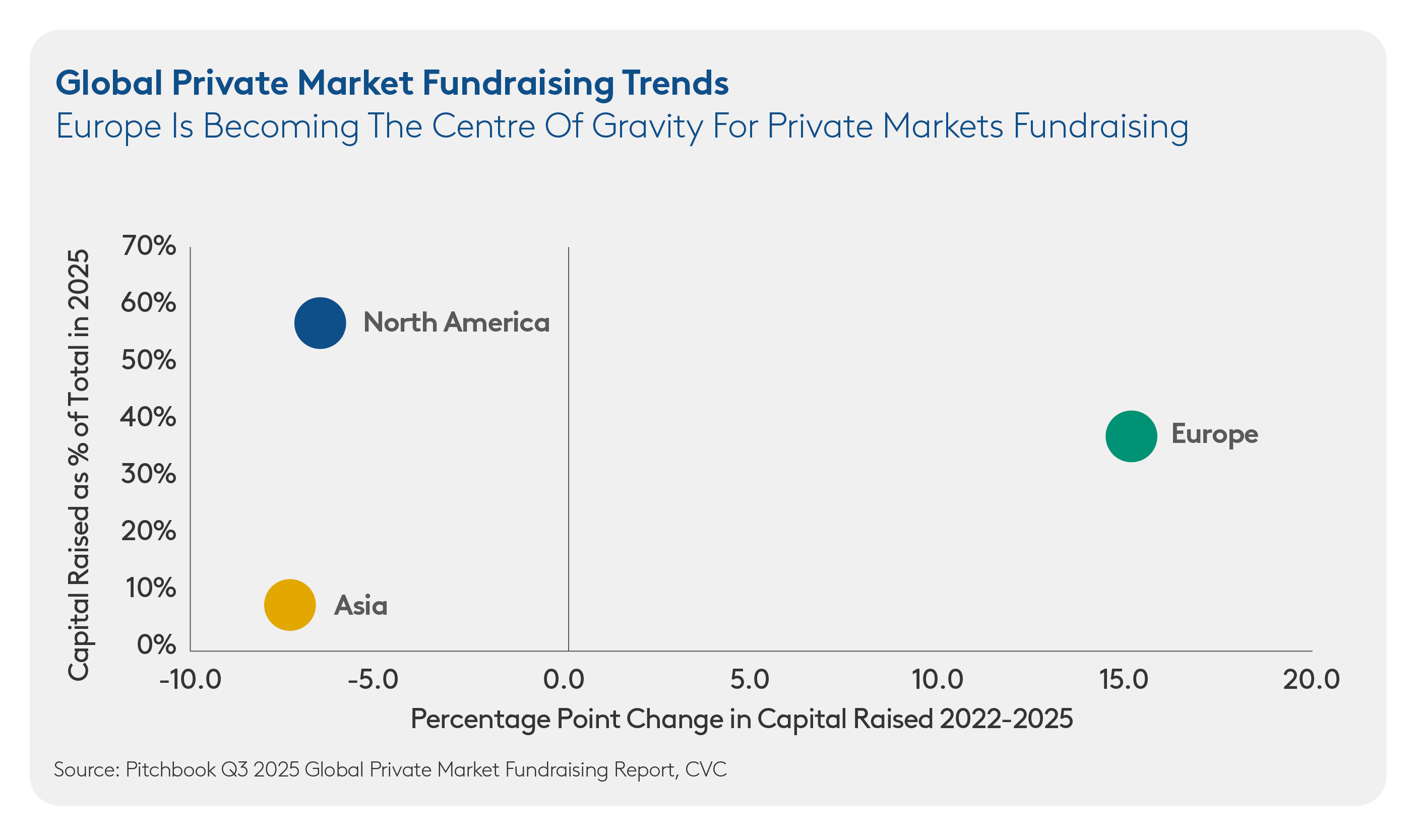

- We believe Europe is well positioned within this environment. Supportive financing dynamics, a more constructive regulatory2 and fiscal backdrop, and exposure to strategic growth sectors continue to attract capital flows.

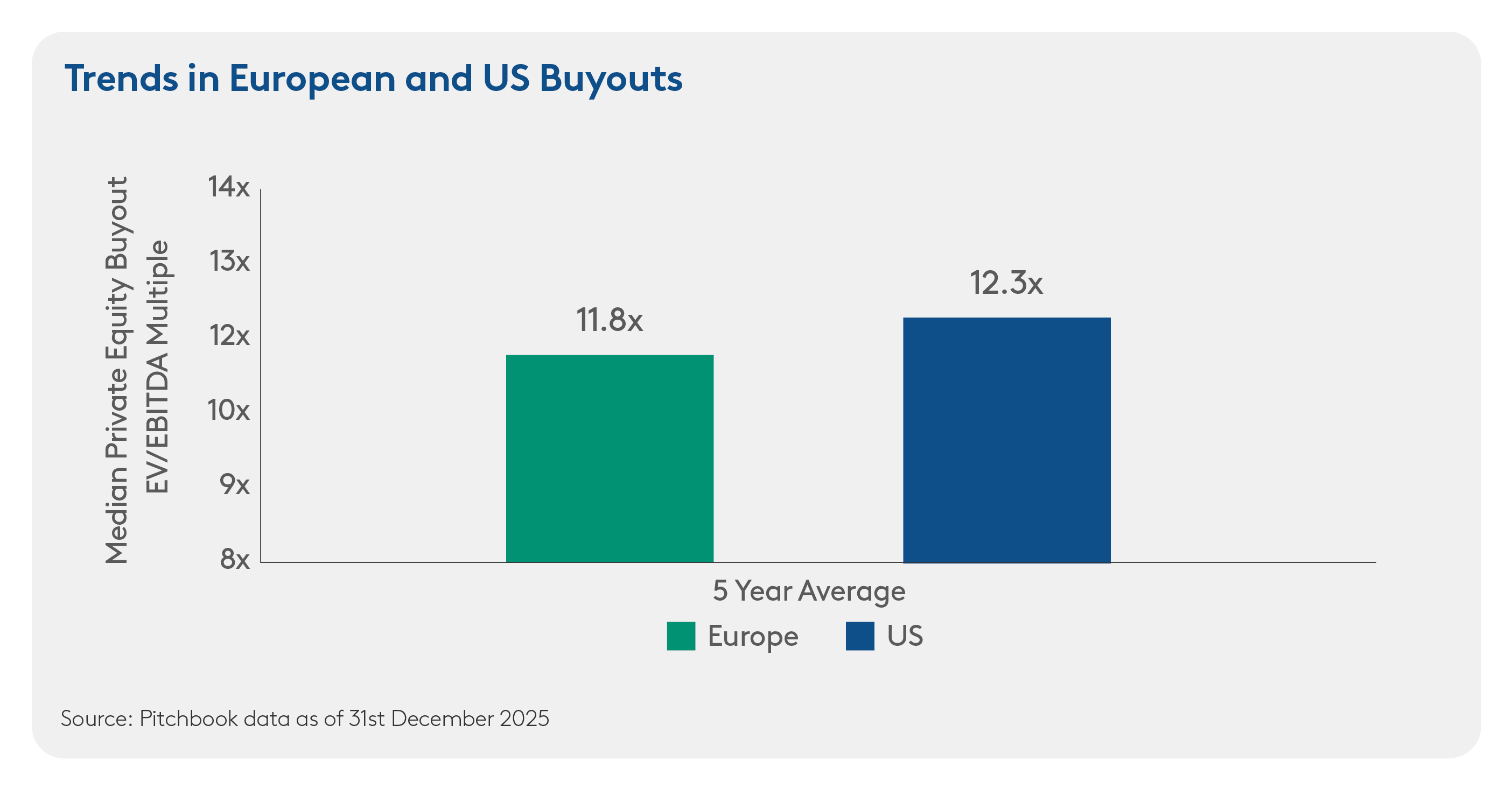

Valuations: Europe With An Advantage

- European buyouts typically trade at lower valuation multiples than those in the US, reflecting structural differences in how transactions are sourced and executed.

- Europe’s market is more fragmented adding a greater reliance on local, relationship-driven sourcing. Transactions are more frequently bilateral rather than auction-led, limiting buyer overlap and competitive intensity, supporting more disciplined entry pricing.

- By contrast, the US private equity market is deeper and more consolidated, with a larger pool of buyers and more consistently competitive auction dynamics, which tend to drive higher valuations and reduce the advantage of local expertise

- While interest from global investors in Europe is increasing, these structural characteristics are likely to persist in 2026, supporting continued valuation differentiation despite rising cross-border capital flows.

Private Credit 2026 Outlook

Europe enters 2026 with strong fundamentals and increasing regulatory clarity. Across M&A, refinancings, add-ons and selective buyouts, the opportunity set continues to broaden, favouring disciplined and selective underwriting.

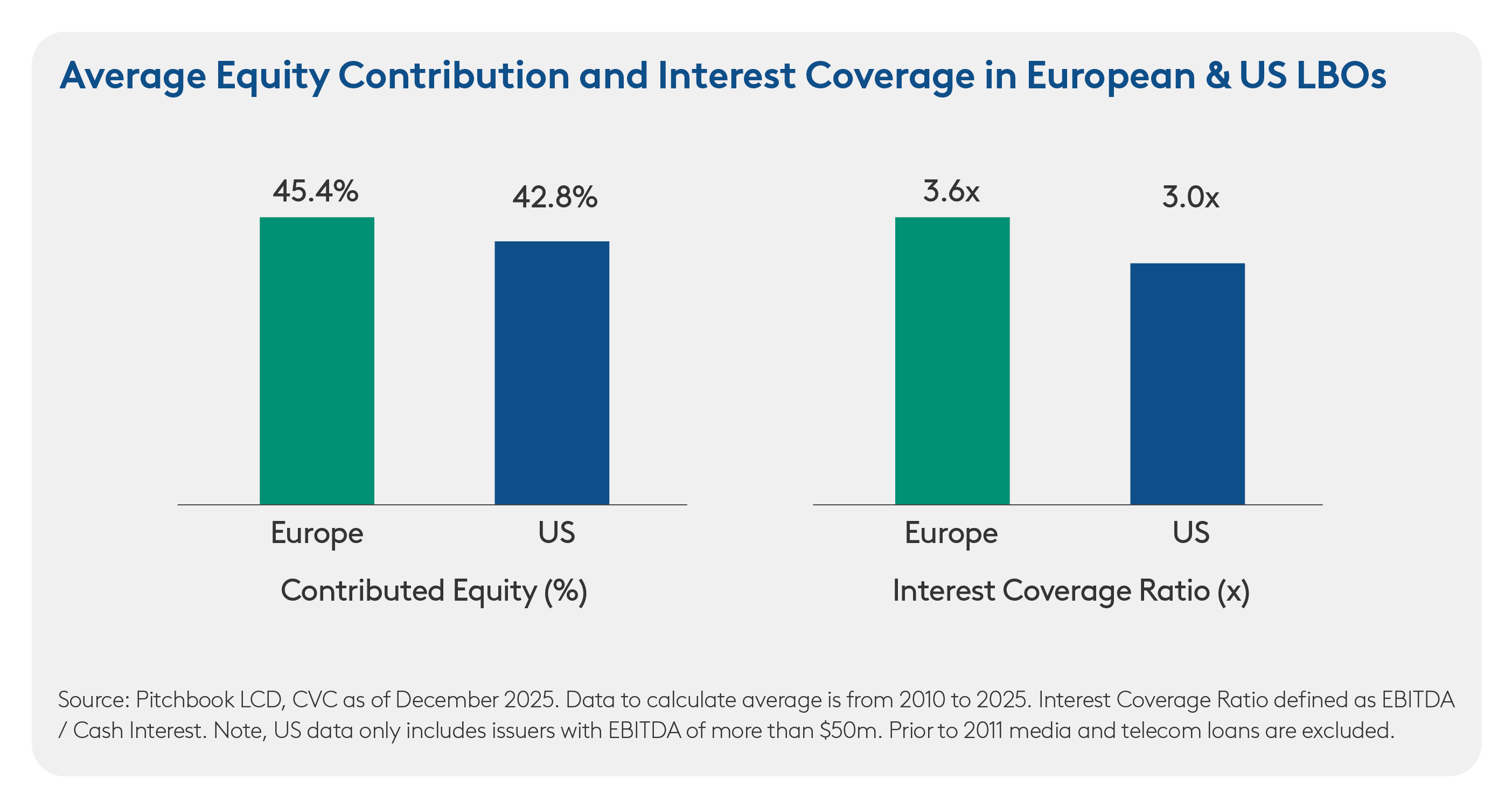

Credit Quality: Structurally More Conservative

- European loans have consistently exhibited stronger interest coverage ratios than those in the US, and we expect this resilience to continue into 2026.

- Default rates in both regions remain within historic norms, despite intermittent market volatility.

- The European market retains structural characteristics that support credit quality: generally lower leverage, creditor-friendly restructuring frameworks and favourable documentation standards.

- Market behaviour also differs. Europe tends to show less tolerance for aggressive balance sheet engineering, helping preserve value for senior secured lenders.

- In this environment, selectivity is important. Partnering with local managers who combine disciplined underwriting with active portfolio monitoring remains a key differentiator.

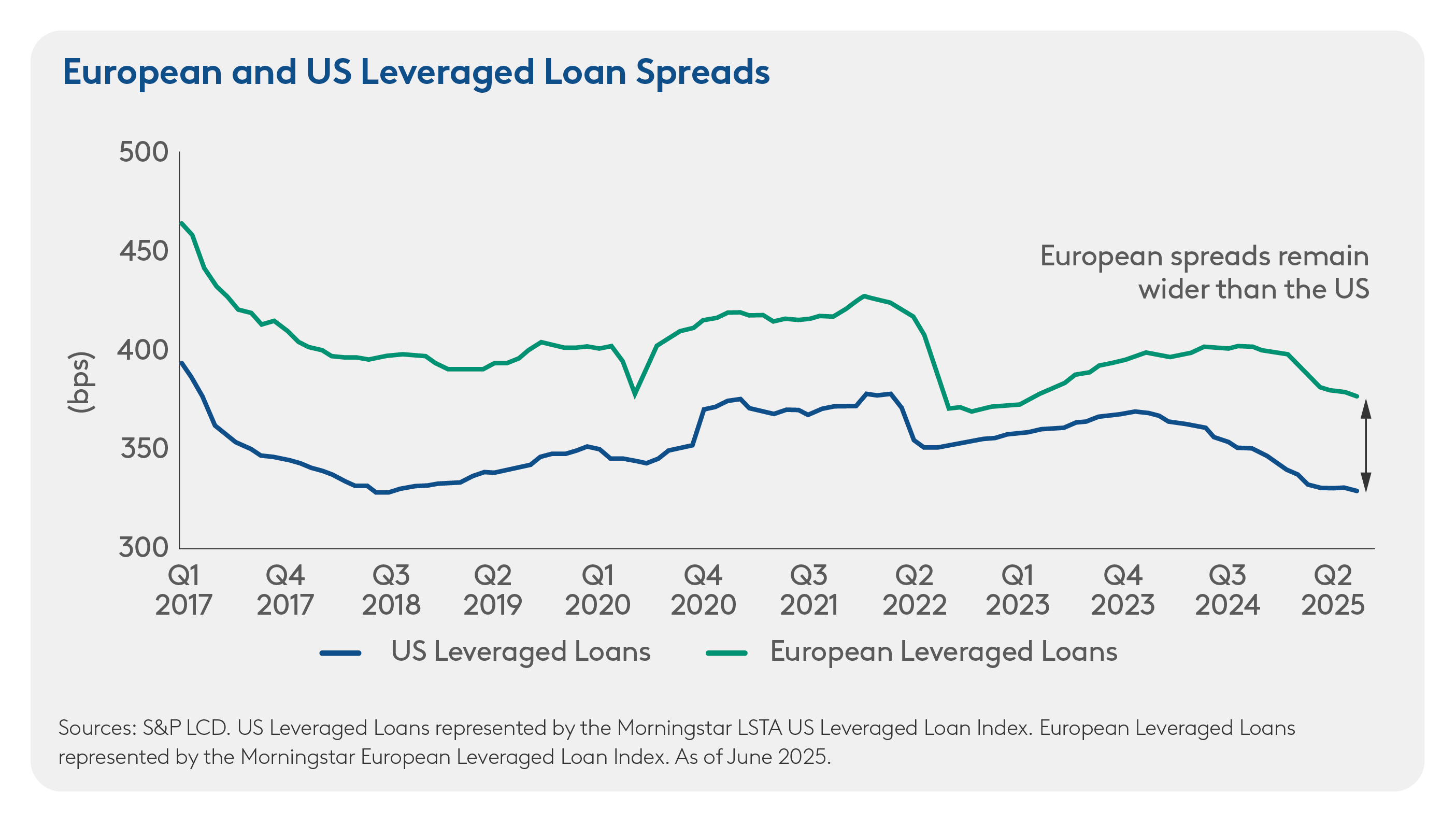

Spreads: Europe To Continue Offering A Premium

- Europe continues to offer a structural spread advantage. This helps preserve attractive income opportunities even as more capital flows into the region’s private credit market.

- This premium reflects several long-standing characteristics of the European market. Continued bank retrenchment, driven by regulatory requirements, has created space for private lenders to provide fast, flexible financing solutions.

- At the same time, Europe’s fragmented markets require bespoke underwriting approaches, limiting competition and helping to avoid the uniform spread compression observed in the US.

- Capturing this advantage depends on strong local origination capabilities. Long-standing sponsor relationships and on-the-ground teams provide early access to high-quality opportunities, supporting stronger economics and more robust creditor protections.

Bottom Line

- Europe enters 2026 with robust fundamentals and improving macro visibility, supporting a broadening opportunity set across private markets.

- Long-standing bank retrenchment, persistent market fragmentation and relationship-driven sourcing continue to underpin a durable opportunity set across European private equity and private credit.

- Access and execution matter more than ever. Origination depth, local networks and disciplined ownership or underwriting increasingly drive outcomes. This favours experienced managers able to navigate complexity across regions and sectors.

- For investors, European private markets offer the potential for attractive relative value, stable income and meaningful diversification across market cycles.

1 Average Annual Vix as of December 2025, Source FRED St. Louis Federal Reserve Bank.

2 Deal activity in Europe gains momentum heading into 2026

DISCLAIMER:

Nothing in this publication constitutes a valuation or investment judgment regarding any specific financial instrument, issuer, security, or sector mentioned or referenced herein. The content presented does not represent a formal or official view of CVC and is not intended to relate specifically to any investment strategy, vehicle, or product offered by CVC. This publication is provided solely for informational purposes and is intended to serve as a conceptual framework to support investors in conducting their own analysis and forming their own views on the subject matter discussed. No assurance can be given that any investment strategy discussed will be successful. Past market trends are not reliable indicators of future performance, and actual outcomes may vary significantly. The information, including any commentary on financial markets, is based on current market conditions, which are subject to change and may be superseded by subsequent events. THIS CONFIDENTIAL DOCUMENT IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION AND MAY NOT BE USED FOR AND DOES NOT CONSTITUTE AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO SUBSCRIBE FOR OR PURCHASE ANY INTERESTS OR TO ENGAGE IN ANY OTHER TRANSACTION. Nothing contained herein shall be deemed to be binding against, or to create any obligations or commitment on the part of, the addressee nor any of CVC Capital Partners plc, Clear Vision Capital Fund SICAV-FIS S.A, each of their respective successors or assigns and any form of entity which is controlled by, or under common control with CVC Capital Partners plc or Clear Vision Capital Fund SICAV-FIS S.A. (from time to time the “CVC Entities“ or “CVC” and each a “CVC Entity”). For the purpose of the foregoing definitions, control includes the power to (directly or indirectly and whether alone or with others) appoint or remove a majority of an entity’s directors or its general partner, manager, adviser, trustee, founder, guardian, beneficiary or other management officeholder) and controlled and controlling shall be interpreted accordingly. No CVC Entity undertakes to provide the addressee with access to any additional information or to update this Confidential Document or to correct any inaccuracies herein which may become apparent. Certain information contained herein (including certain forward-looking statements, financial, economic and market information) has been obtained from a number of published and non-published sources prepared by other parties and companies, which may not have been verified and in certain cases has not been updated through the date hereof. While such information from other parties and companies is believed to be reliable for the purpose used herein, no member of CVC, any of their respective affiliates or any of their respective directors, officers, employees, members, partners or shareholders assumes any responsibility for the accuracy or completeness of such information. Certain economic, financial, market and other data and statistics produced by governmental agencies or other sources set forth herein or upon which the CVC’ analysis and decisions rely may prove inaccurate. Nothing contained herein shall constitute any assurance, representation or warranty and no responsibility or liability is accepted by CVC or its affiliates as to the accuracy or completeness of any information supplied herein or any assumptions on which such information is based. Further, this Confidential Document reflects only the views of CVC with respect to private equity markets and other market participants may hold different views or opinions. Accordingly, each Recipient should conduct their own independent due diligence and not rely on any statement or opinion offered herein. In addition, no responsibility or liability or duty of care is or will be accepted by CVC or its respective affiliates, advisers, directors, employees or agents for updating this Confidential Document (or any additional information), or providing any additional information to you. Accordingly, to the fullest extent possible and subject to applicable law, none of CVC or its affiliates and their respective shareholders, advisers, agents, directors, officers, partners, members and employees shall be liable (save in the case of fraud) for any loss (whether direct, indirect or consequential), damage, cost or expense suffered or incurred by any person as a result of relying on any statement in, or omission from, this Confidential Document.