Capital Solutions: Flexibility that Powers Private Markets

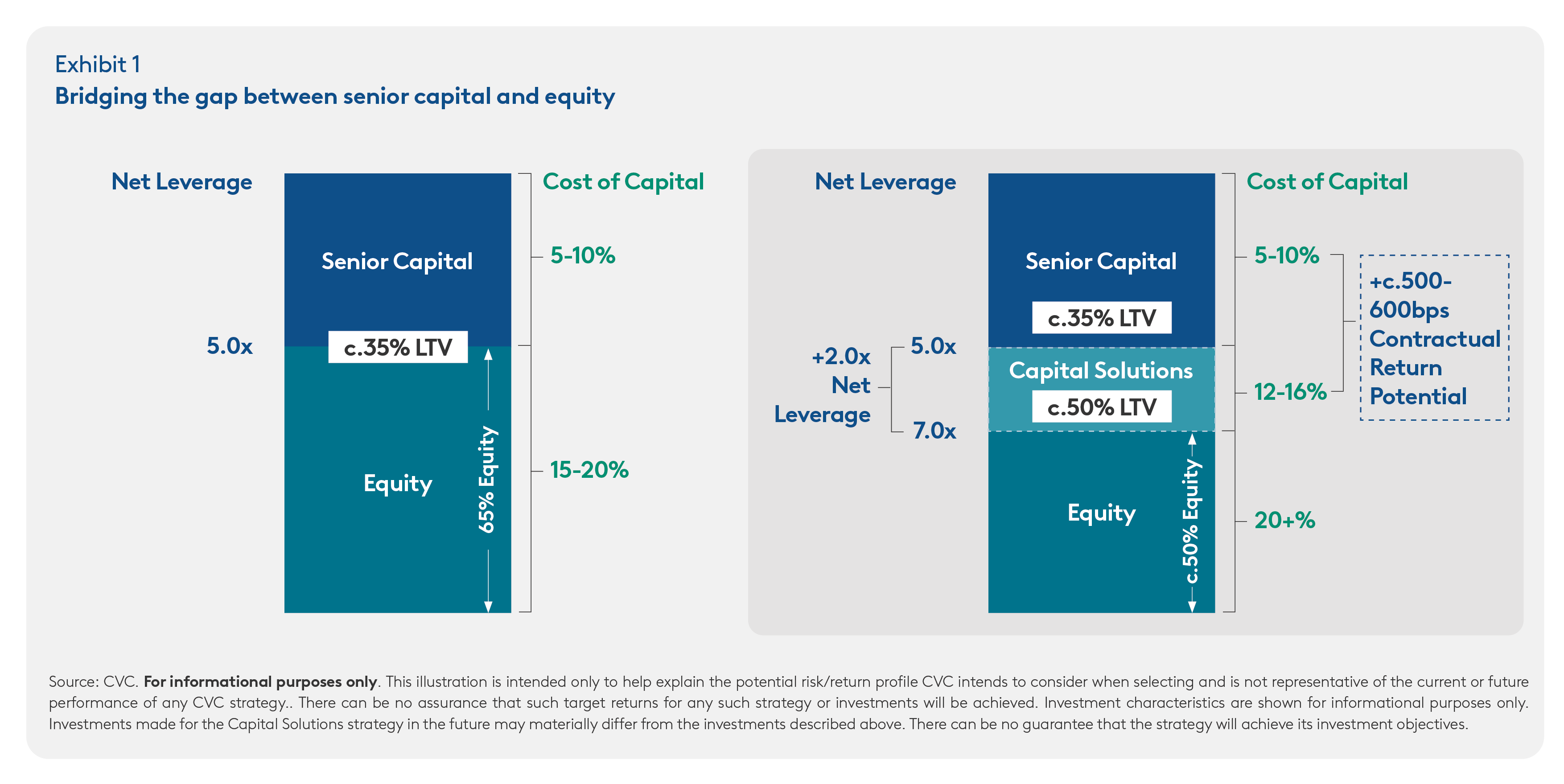

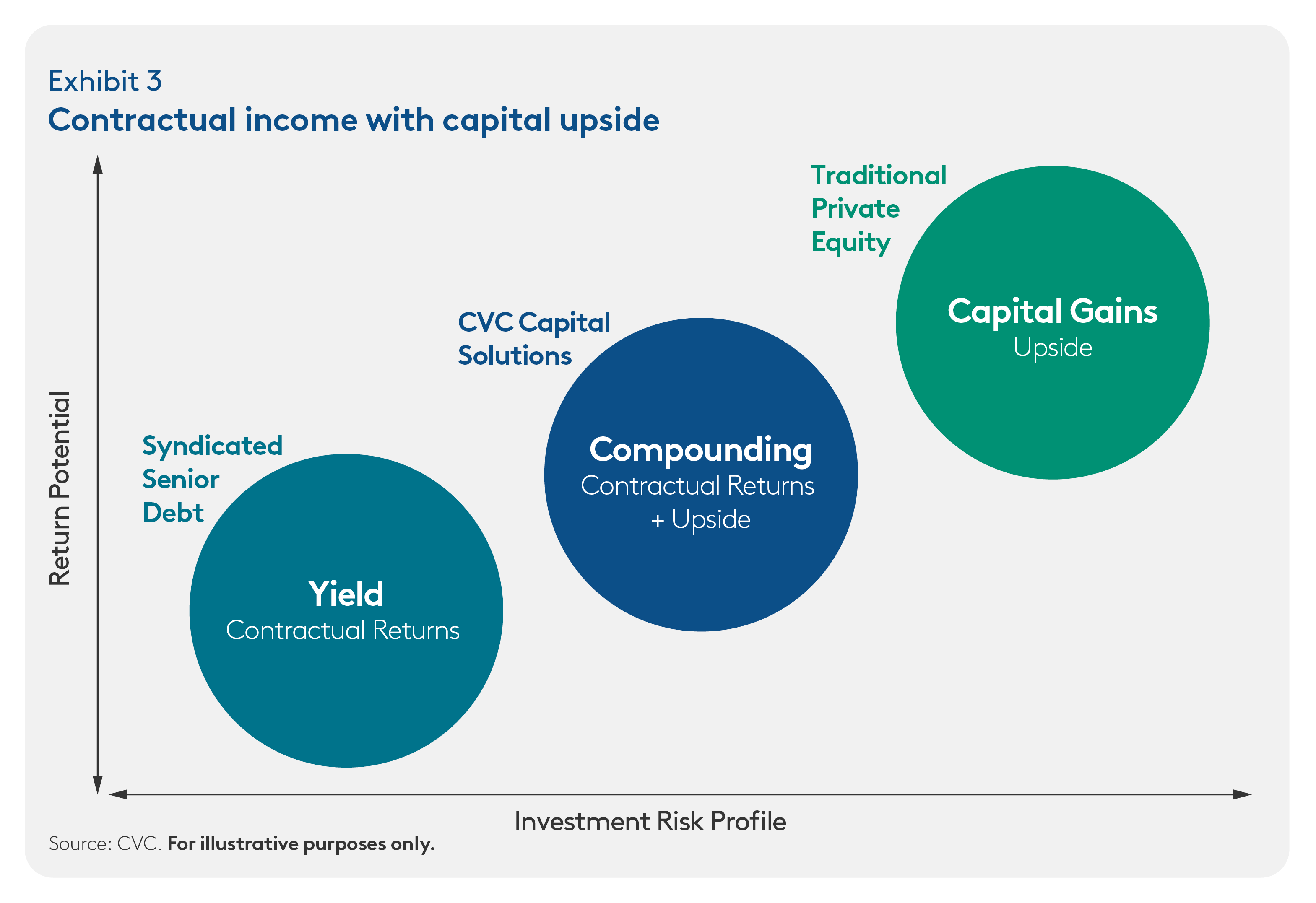

Capital solutions, flexible forms of junior and hybrid capital, represent a growing and increasingly vital asset class within private credit. Positioned between syndicated senior debt and equity, these strategies provide bespoke financing that address sponsor and borrower needs, enabling transaction activity across market cycles. By combining contractual returns, downside protection and attractive upside potential, we believe capital solutions can offer investors a differentiated risk/return profile that complements traditional allocations.

Key Takeaways

-

Capital Solutions are key enablers of sponsor activity throughout all economic environments, allowing investors to secure preferential economics and diverse origination opportunities through the cycle.

-

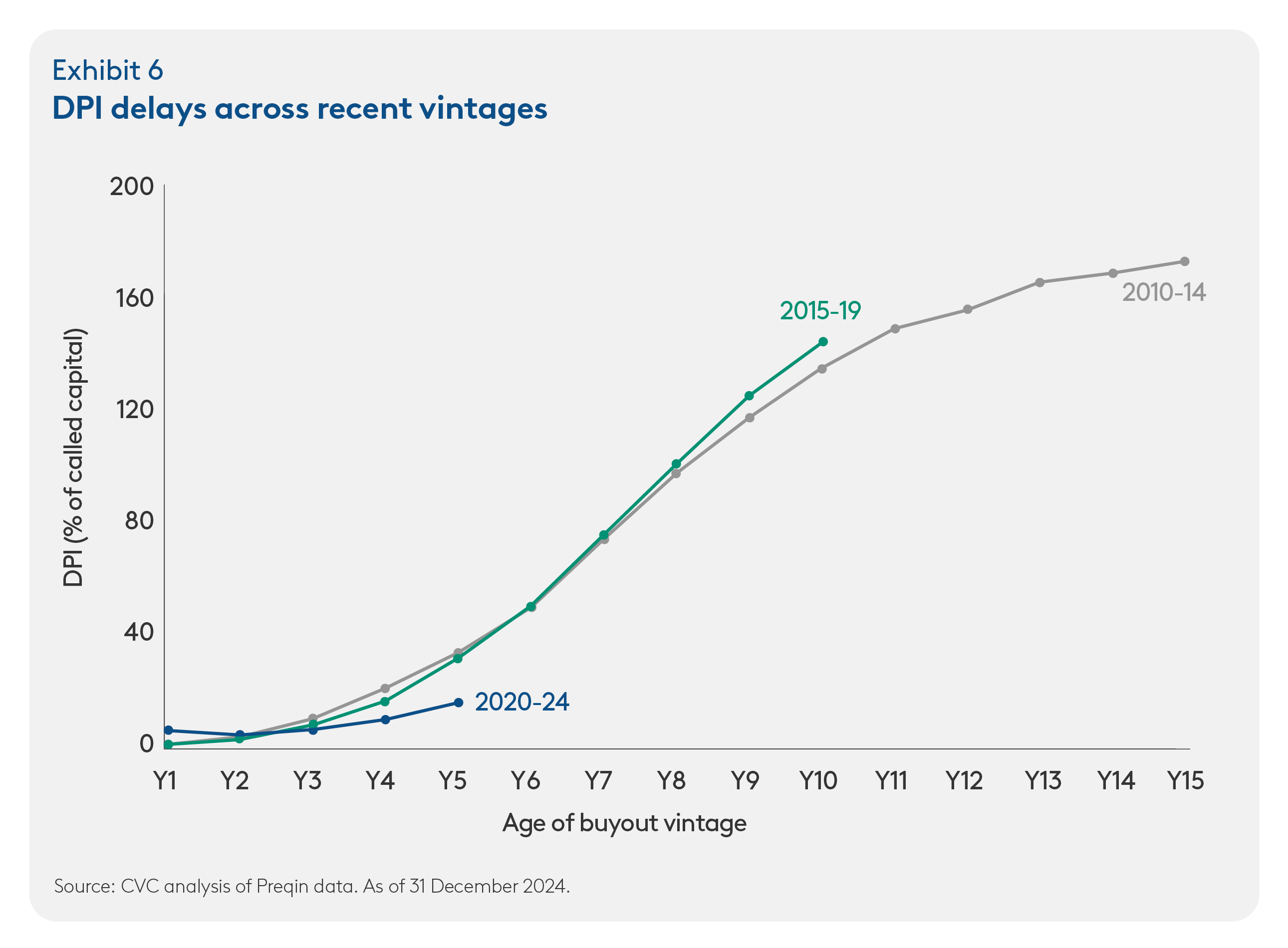

Borrower demand for tailored and complex financing has risen steadily over recent years, driven primarily by ongoing bank retrenchment, periodic challenges in syndicated markets, muted M&A activity and longer private equity holding times, resulting in below expectation DPI for recent vintages.

-

For investors, capital solutions can provide differentiated, resilient returns with low correlation to public markets, offering equity-like return potential with fixed-income-like protection.

-

A disciplined, relationship-driven approach focused on high-quality, sponsor-backed companies, conservative capital structures and privately negotiated deals, can support consistent deployment and strong risk-adjusted returns across market environments.

Capital solutions refer to flexible forms of financing – i.e., junior and hybrid capital – that sit between traditional debt and equity. Capital solutions instruments may include second-lien debt, payment-in-kind (PIK) loans and preferred or structured equity. These solutions are typically customised and contractual in nature, with investors often targeting mid-teen internal rates of return (IRRs).

Solutions fit for purpose

Whether to finance M&A, refinance debt, raise non-dilutive equity or access capital amidst volatility, the need for a broader selection of capital solutions catering to specialist situations has expanded sharply over the past decade.

Borrowers find this flexible capital invaluable for meeting a range of needs – perhaps most notably today, the release of liquidity from existing private equity portfolios for DPI generation amid the slower exit environment.

These bespoke solutions are highly valued by borrowers, as they often bridge the gap between syndicated senior debt and equity, unlocking transactions. As a result, capital providers are able to secure preferential economics in these deals.

Differentiated and attractive returns

The premium achievable over traditional debt, which derives from higher contractual returns and structural upside potential, is one of the key appeals of capital solutions investing. While there is a diversity of opportunity in the market, our deals focus on equity subordination at healthy attachment points (typically upwards of 50% LTV) and directly negotiated documentation. Together, this combination shapes a return profile more in keeping with traditional fixed income.

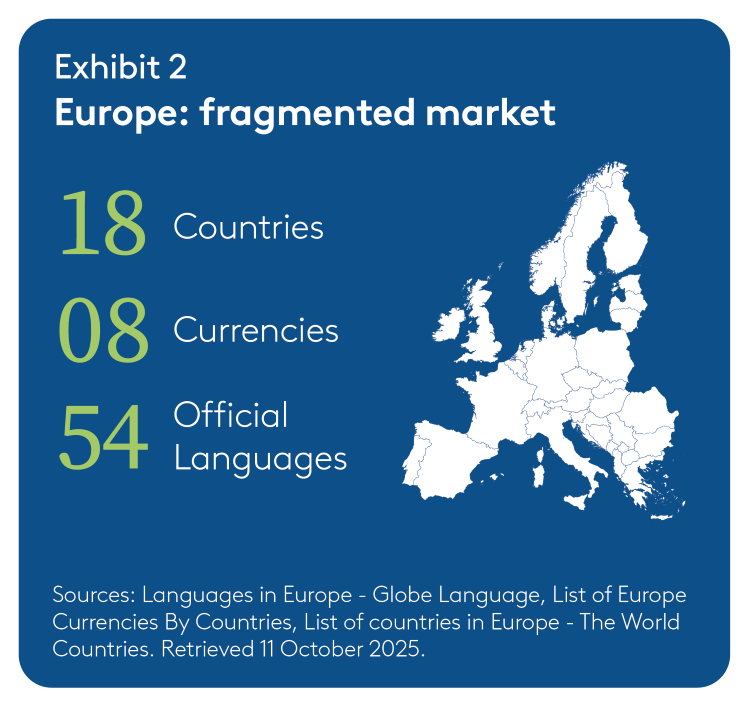

Within the opportunity set, European transactions present outsized investment potential. This reflects the region’s highly diverse and fragmented markets, with varied regulations and disparate lender bases creating inefficiencies that lead to structurally wider spreads.

Investors with local presence, strong relationships and a partnership approach can capture these advantages while negotiating more robust documentation than is typically found in the U.S.

For investors seeking idiosyncratic pay offs and structural complexity over market beta, capital solutions offer an investment edge through their blend of meaningful spread premium above senior tranches as well as downside protection.

With public market valuations near all-time highs, we believe capital solutions can offer a timely source of differentiated returns.1

Sourcing powered by innovation

The range of borrowers and instruments to which capital solutions are well suited continues to broaden, reflecting their versatility and responsiveness. This innovation has produced more tailored, adaptive structures that cater to unique needs, while also fostering a durable investment landscape with a depth of opportunity.

Whether facilitating M&A, refinancing, strategic structuring or capturing opportunities amid market dislocations, flexible finance has become integral to modern markets.

Over the past decade, capital solutions have been particularly relevant in four key areas:

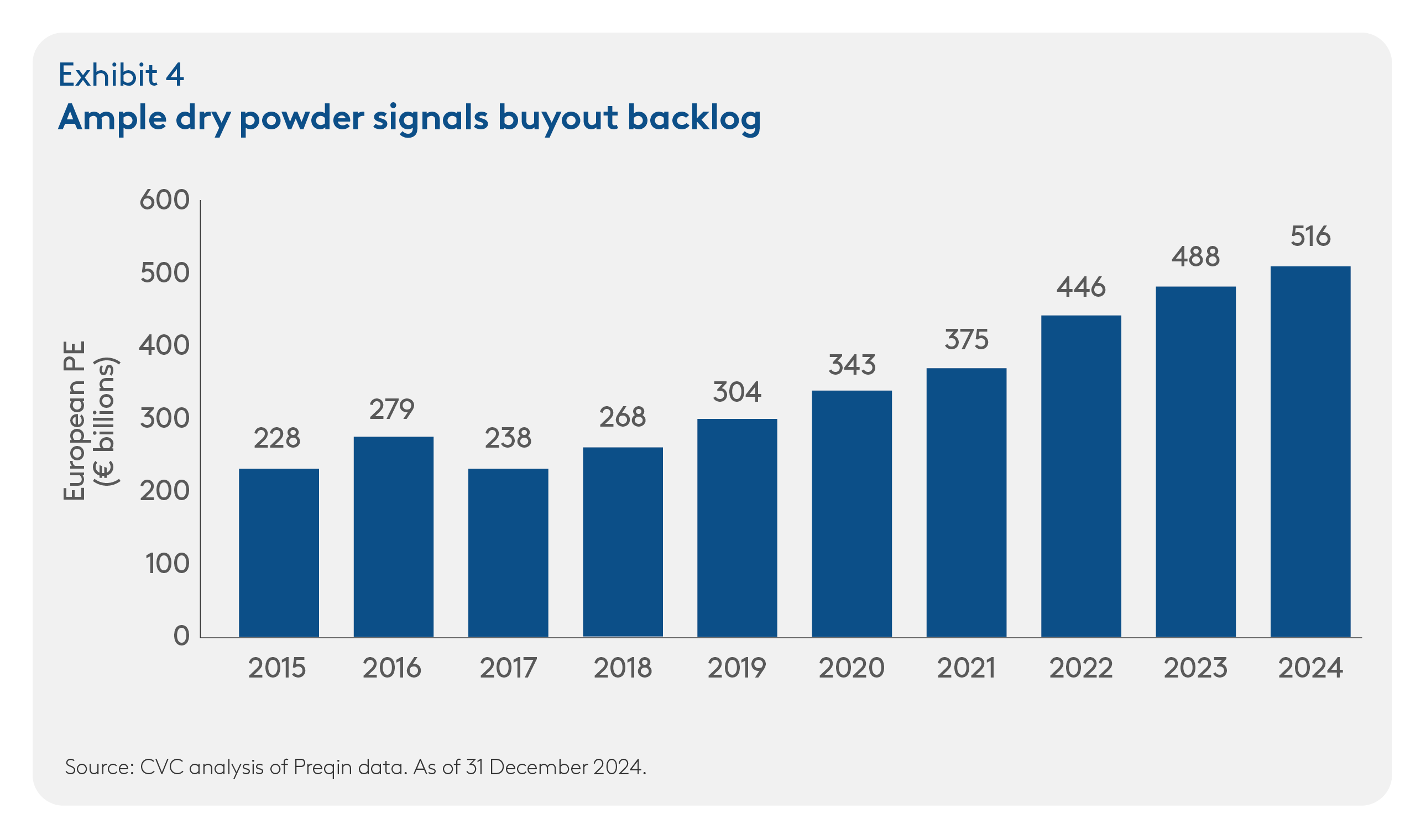

- M&A – Bespoke, partnership-oriented financing that unlocks transactions. In this respect, capital solutions are well suited to the many high-quality companies that command elevated purchase multiples but face funding constraints due to bank-lending caps. With €516bn of private equity dry powder in Europe (Exhibit 4), today’s significant M&A backlog should translate into stronger deal flow when sponsor deployment resumes.

- Refinancings – Flexible structures to address upcoming maturities, interest cost management (including PIK features), consolidation of multi-tranche facilities and acquisition financing with customised structuring to mitigate cashflow drag. In 2024 alone, refinancings reached €38 billion in Europe.

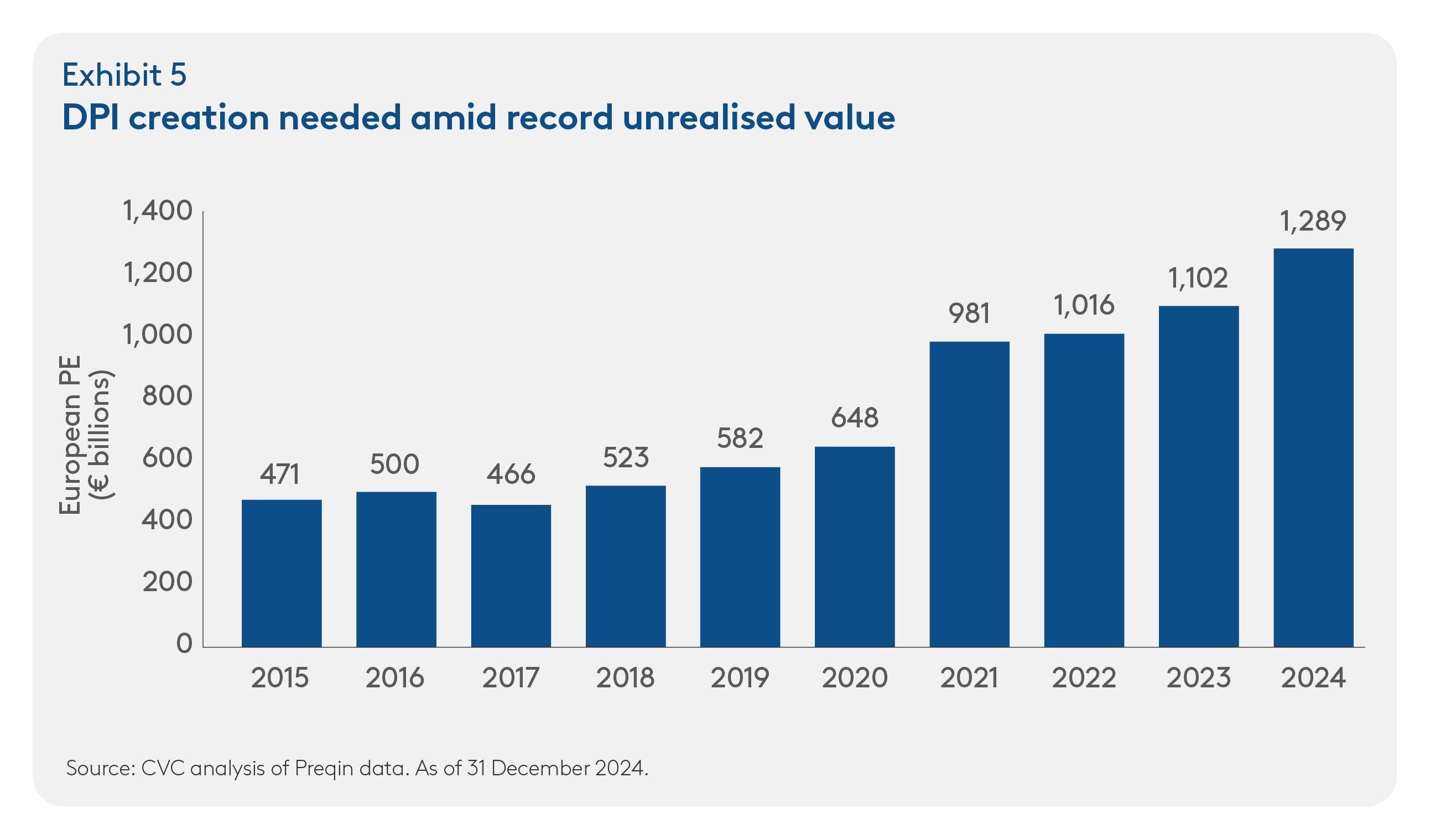

- Strategic solutions – Recapitalisations and capital structure optimisation tailored to specific sponsor and founder objectives, including non-dilutive capital, partial exits or the selective introduction of institutional partners. With median European PE hold periods at a 10-year high (3.6 years)5 and aggregate unrealised value of €1.3 trillion (Exhibit 5), capital solutions are increasingly critical for DPI generation.

- Opportunistic situations – Seizing opportunities in hung syndications and direct financings when banks and public markets pull back amid market dislocations. The volatility of 2020, 2022 and 2025 underscored the valuable role of capital solutions when other financing became temporarily unavailable. Since 2021, hung syndications have totalled €19bn in Europe.

For these reasons, capital solutions investing is not dependent on market timing. While cyclical upticks in M&A can strengthen deal flow, it is the consistent demand for bespoke and non-dilutive capital that ensures steady deployment opportunities through the cycle.

Whether facilitating M&A, refinancing, strategic structuring or capturing opportunities amid market dislocations, flexible finance has become integral to modern markets.

Structural tailwinds

As private markets continue to mature, the opportunity set for capital solutions is expanding in tandem. Diverse demand drivers sustain consistent and strong origination opportunities through the cycle, with a lack of distributions in Private Equity constituting a key part of the opportunity set emerging over recent years.

Borrowers increasingly require flexible financing to optimise balance sheets, manage upcoming maturities and control interest expenses, all without triggering a full recapitalisation or exit of their portfolio companies.

In this respect, private equity sponsors particularly value capital solutions. With portfolio holding times close to record levels and slower DPI momentum (Exhibit 6), many GPs now use capital solutions to create distributions for LP investors without diluting their equity stakes.

Capital solutions may not suit every portfolio company, as not all deserve or support these structures. However, there is a significant opportunity set of high-quality companies to which they are well-suited and return accretive - companies with clear paths to further value creation, provided their private equity owners can defer realisation.

As with sponsors, founder-led companies also turn to this flexible financing to bring in institutional growth capital and expertise, while retaining company control.

By enabling borrowers to extend runway, preserve equity value and navigate complex capital needs, these solutions have become integral strategy levers for both sponsors and company owners alike.

CVC’s extensive Private Equity heritage and European platform provide a competitive advantage in analysing and structuring debt solutions tailored to sponsor needs, while retaining strong documentation with return profiles focused on contractual components.

Underwriting for success

Flexibility defines capital solutions, which can occupy virtually any rung – or combinations of rungs – in the capital stack, each with distinct risk/return characteristics.

Capital solutions instruments span unitranche and senior loans, subordinated debt, hybrid securities and preferred equity. Underwriters skilled in structuring these instruments can design transactions around company-specific needs with bespoke documentation and tailored cash-flow waterfalls.

Given their complexity and level of subordination, these instruments typically command wider spreads than first-lien debt. Yet their “middle-of-the-stack” position provides more meaningful repayment protection than common equity alongside this more attractive income.

Importantly, these well-structured, tailored transactions underpin the asymmetric profile for which capital solutions are well known. That is, steady, high current income plus equity-like returns with lower loss severity than common equity.

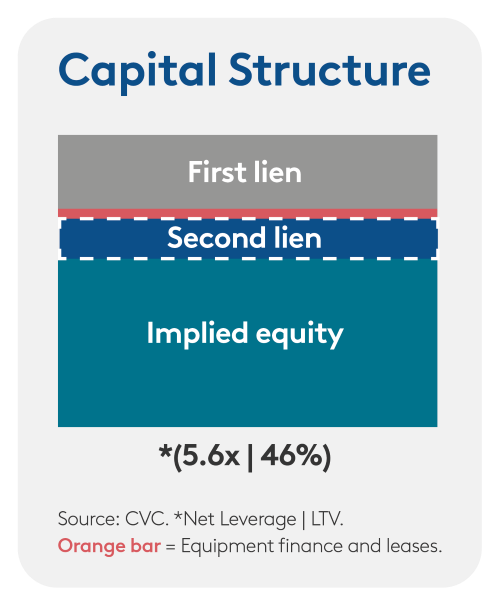

Company A: The company is a leader in Central Europe’s rapidly modernising healthcare sector, operating its nation’s largest private cardiology and hospital network with 6,000+ employees across over 100 facilities. Following its acquisition by a major European healthcare group, the company expanded by acquiring another local hospital network and began a programme to modernise public facilities.

Capital Solution: To fund this growth, CVC Credit provided a tailored 2nd lien financing of ~€200 million. The transaction helped the owner optimise the capital structure, maintain their public credit rating and ensure alignment between the subsidiary and its parent. With conservative leverage (c.5.6x) and loan-to-value (c.46%), the financing delivered both attractive return potential and flexibility.

CVC: Acting as sole capital provider, CVC leveraged its network – particularly its healthcare expertise – to originate and execute the transaction. The bespoke capital package enabled management to focus on expanding patient capacity, improving rehabilitation and outpatient services, while strengthening partnerships within the public healthcare system.

Disciplined process, durable performance

With capital solutions, a manager’s investment approach is decisive to safeguarding capital and generating steady, risk-adjusted returns.

CVC’s disciplined strategy focuses on three integrated priorities:

Capital Preservation – Targeting established borrowers in non-cyclical sectors with conservative capital structures, substantial equity cushions and top-tier sponsor backing to ensure meaningful downside protection and stable earnings.

Rigorous Investment Process – By leading or co-leading privately negotiated transactions, we customise terms to suit borrower needs while maintaining prudent underwriting standards. Every opportunity undergoes comprehensive diligence, leveraging real-time market intelligence from CVC’s global network.

Portfolio Construction & Active Management – We build diversified portfolios under strict credit criteria, continuously monitoring our investments through a dedicated team and actively manage exposures to mitigate risk and preserve capital.

CVC’s edge: Insights and access

Relationships are central to our capital solutions strategy, which benefits from CVC’s network of 521 investment professionals across 30 offices on six continents. We find that the CVC network enhances our market insight, access to proprietary deal flow and speed of execution when attractive opportunities arise.

The strategy also benefits from strong synergies across CVC’s broader platform. It shares target characteristics with our Flagship Private Equity strategy – focusing on mid-sized, high-quality businesses with robust recurring revenues – and our Strategic Opportunities strategy, which focuses on partnership-oriented solutions.

In practice, these synergies bring two key advantages:

Depth of insight – CVC’s sector and country expertise, built with over 40 years of on-the-ground presence, provides granular understanding of local companies and markets.

Forward visibility – Our teams actively monitor forward-looking deal flow through our private equity and private debt strategies, often identifying opportunities months before peers.

This collaboration expands our opportunity set, while sharpening our underwriting precision. Over 70% of deals in CVC’s capital solutions strategy involve contributions from our private equity country and sector teams, a figure evidencing the platform’s integration and shared conviction.

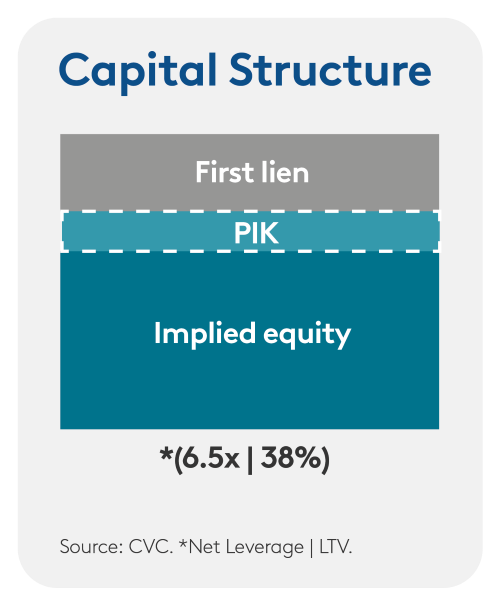

Company B: A global leader in nuclear medicine, the company provides diagnostic and therapeutic solutions that enable early detection and treatment of cancer and other critical diseases. Formed through the merger of two imaging specialists, it holds leading positions in Europe and North America with strong regulatory credentials, vertical integration and long-term customer contracts.

Capital Solution: In connection with the sale of the business to a continuation vehicle – designed to deliver DPI to investors – CVC is supporting the sponsor’s aim to optimise its capital structure by refinancing an existing PIK instrument with a new PIK facility providing long-term, non-dilutive capital.

CVC: As an incumbent lender with deep sector knowledge and prior exposure since 2020, CVC leveraged its healthcare expertise and local networks to execute swiftly, delivering flexible financing that combined downside protection with attractive return potential.

Bottom line

As private markets evolve and sponsors seek more agile capital to support longer holding periods, balance sheet optimisation and transitional needs, the relevance of capital solutions continues to grow.

By combining characteristics from both fixed-income and equity, the investment performance of capital solutions depends less on market direction and more on the need for bespoke structuring designed to address specific needs, such as DPI generation when exits slow. The private market nature of these investments also provides insulation from public-market volatility for greater portfolio stability.

For borrowers, flexible capital remains a critical element of transaction success, justifying the premium they pay. For investors, that premium translates into attractive, uncorrelated returns that often exceed those available in traditional fixed-income.

When executed with discipline, selectivity and deep market insight, capital solutions can represent a highly complementary allocation, diversifying portfolios while also supporting great businesses to create lasting value across cycles for both investors and borrowers.

Important Information:

This publication has been prepared solely for informational purposes and is not a solicitation of an offer to buy or sell any securities or to adopt any investment strategy. The information contained herein is only as current as of the date indicated and may be superseded by subsequent market events or for other reasons. Charts and graphs provided herein are for illustrative purposes only. The information in this document has been developed internally and/or obtained from sources believed to be reliable; however, CVC Credit nor CVC guarantees the accuracy, adequacy or completeness of such information. Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied on in making an investment or other decision.

The information in this publication may contain projections or other forward-looking statements regarding future events, targets, forecasts or expectations regarding the strategies described herein, and is only current as of the date indicated. There is no assurance that such events or forecasts will be achieved and outcomes may be significantly different from that shown here. The information in this document, including statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.

1 There is no guarantee that the market opportunity discussed will be sustained in the future or for the duration of the strategy.

2 Preqin as at August 2025.

3 PitchBook | LCD.

4 Preqin as at August 2025. Latest data available as at 31 December 2024.

5 European Credit Markets Weekly Wrap. PitchBook Data, Inc. www.pitchbook.com. As of 10 October 2025.