Secondaries in the Spotlight

With the role of private equity secondaries firmly established in private market portfolios, we examine five key attributes of the strategy that have helped to sustain its growth for the past two decades.

Key attributes

Strategic flexibility: The secondary market delivers optionality in an illiquid asset class. Secondary solutions, structures and transaction types continue to innovate and proliferate in line with the evolving needs of buyers and sellers.

Shorter path to liquidity: Compared to primary investments, secondaries typically deliver faster return of capital and reduced J-curve effects, alleviating liquidity constraints – a key concern for investors today.

Access to seasoned assets: Secondaries investments reduce blind pool risk by targeting assets already progressed in their value creation plans. This allows buyers to underwrite the path forward instead of an investment thesis, while providing a structure to “backfill” sought-after vintages.

Consistent performance: Secondaries typically generate superior median returns with lower volatility than other private market strategies, reflecting structural advantages including a discount at entry, expedited liquidity profile, diversification and informed manager selection.

The rise of GP-led transactions: With transaction volumes expanding and more leading sponsors bringing high-quality assets to market, GP-led transactions have become an established component of the private equity landscape, providing access to star assets that sponsors have elected to hold for the next turn of value.

Strategic flexibility

As an established strategic tool in portfolio management, secondaries continue to see strong momentum, with rising transaction volumes anchored in enduring structural demand drivers that have developed over more than two decades.

Fundamental drivers are varied but centre on a few key themes. Buyers gain greater insight into underlying holdings, seasoned portfolios with visible track records, accelerated cash flows with shorter J-curves and access to assets at discounted valuations.

For sellers, secondaries offer a rapid route to liquidity and portfolio recalibration, critical advantages in an era of muted distributions and lengthening portfolio company holding periods.

Strategic flexibility is the common thread on both sides of transactions. The market today encompasses an expanding base of participants and intermediaries, sophisticated pricing analytics and a broadening menu of deal structure options.

The ability to structure bespoke solutions has become standard practice. Beyond straightforward fund-interest transfers, investors now have access to preferred equity tranches, tender offers and hybrid strip sales blending primary and secondary capital.

With the market’s breadth, depth and sophistication continuing to expand, secondaries are providing greater portfolio-level optionality, leading to more durable, through the- cycle drivers of activity.

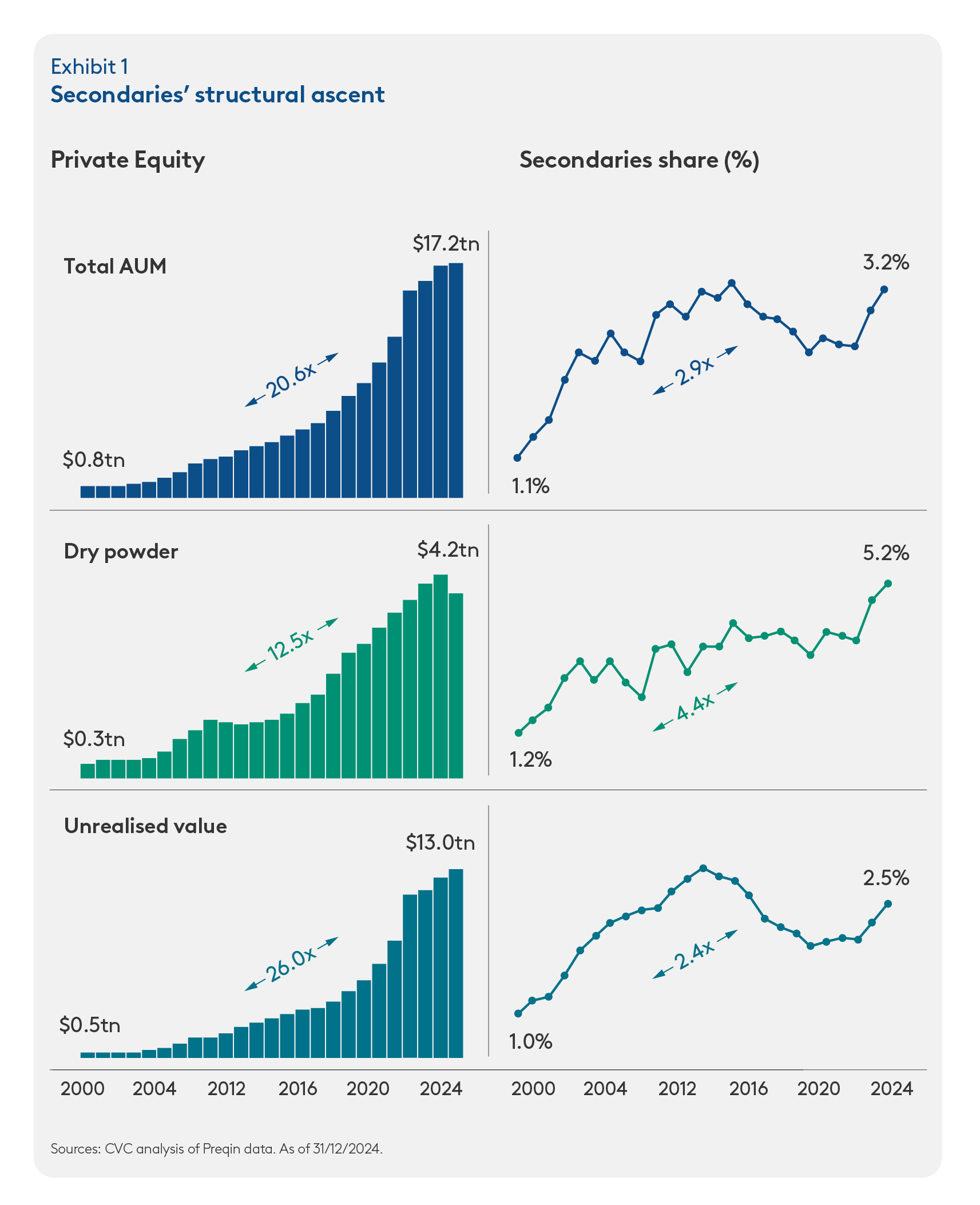

This dynamic has already pushed secondaries’ share of private equity AUM to nearly triple its 2000 level, with momentum accelerating further since the pandemic (Exhibit 1). In absolute terms, this equates to a c.60x rise in secondaries assets since 2000, to a total of $550bn in 2024. In comparison, the wider private equity industry grew by c.20x to $17.2trn in the same period.

In 2025, transaction activity has continued to rise. In the first half, volumes rose to a record $103bn, three-quarters of which came from private equity.1 At this pace, the market is on course to surpass 2024’s record $162bn in annual activity.

Shorter path to liquidity

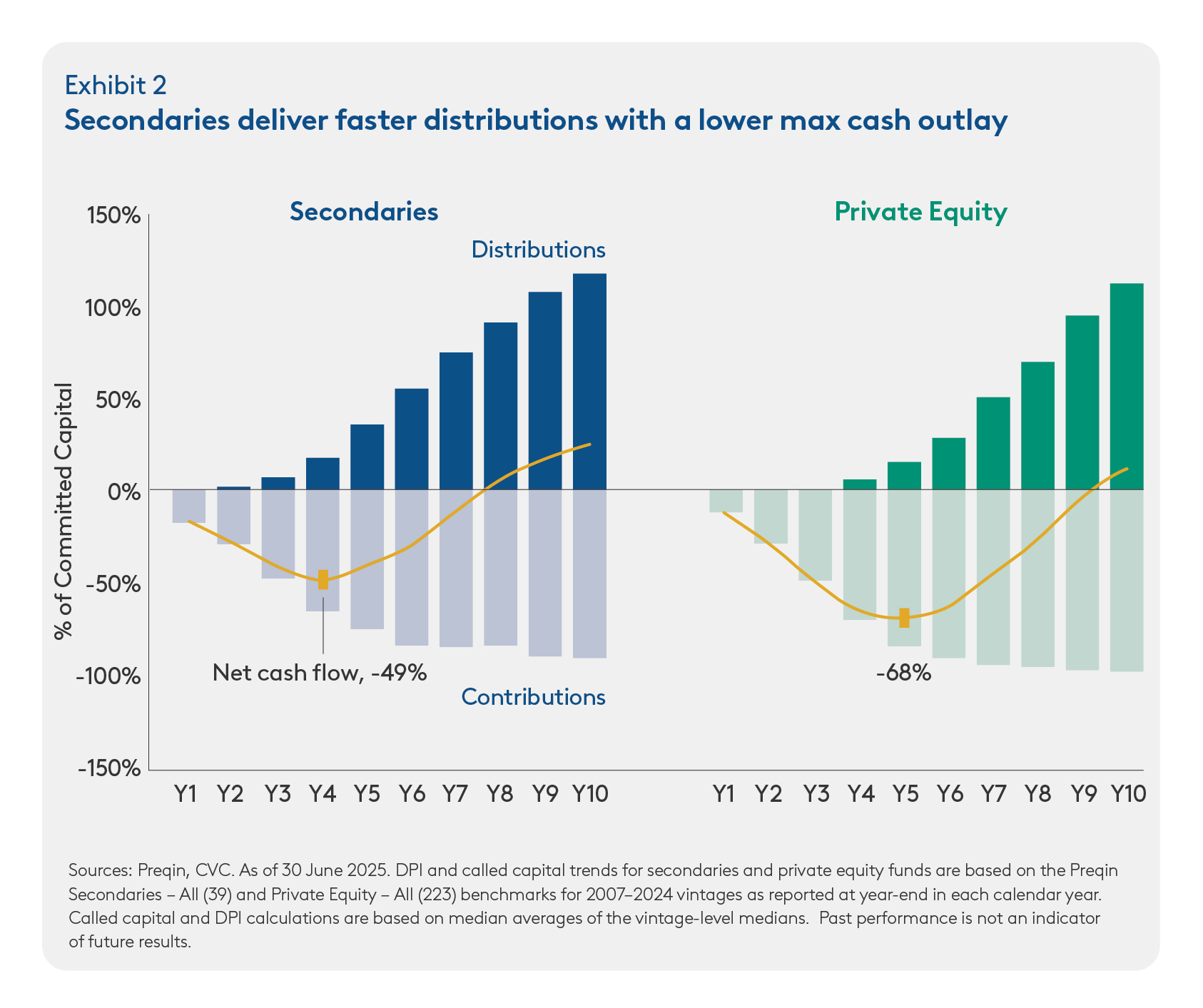

By acquiring assets that are well advanced in their value-creation cycle, secondaries funds typically deliver faster distributions and a shallower J-curve, providing portfolios with a stream of distributions from early in the fund life, a valuable trait in today’s environment.

Exhibit 2 underscores the point. Based on median averages across 2007 to 2021 vintages, a $100 commitment to secondaries would have generated a peak net outlay of just $49 (39% less than the broader private-equity universe) and flipped to positive net cash flow two years sooner.

In a market where exit timelines have lengthened and distributions have slowed, secondaries front-loaded DPI gives allocators clearer visibility on cash flows and exposure levels, translating into tighter liquidity planning and more efficient portfolio management.

Access to seasoned assets

Within private markets, secondaries offer investors distinctive advantages in terms of both access and selection. Unlike primary commitments, they open a window into existing portfolios, providing diversification by geographies, sectors, sponsors, vintage years and market-cap exposures.

By reducing blind-pool risk, secondaries also enhance underwriting confidence. Investors can assess managers with full knowledge of underlying portfolio companies, evaluating not only current trajectories for asset performance but also longer-term GP track records with greater clarity.

Vintage diversification, in particular, is a unique feature. Secondary managers can calibrate allocations across a spectrum of fund vintages, effectively “backfilling” portfolios with sought-after managers by year of fund launch – an option unavailable in other private markets strategies.

Equally, the secondary market affords investors a pathway into coveted GP relationships that might otherwise be closed, or heavily skewed toward incumbent LPs.

Taken together, these attributes can underpin a more calibrated, risk-aware approach to private-market investing.

Secondary managers can calibrate allocations across a spectrum of fund vintages, effectively “backfilling” portfolios with sought-after managers by year of fund launch.

Consistent performance

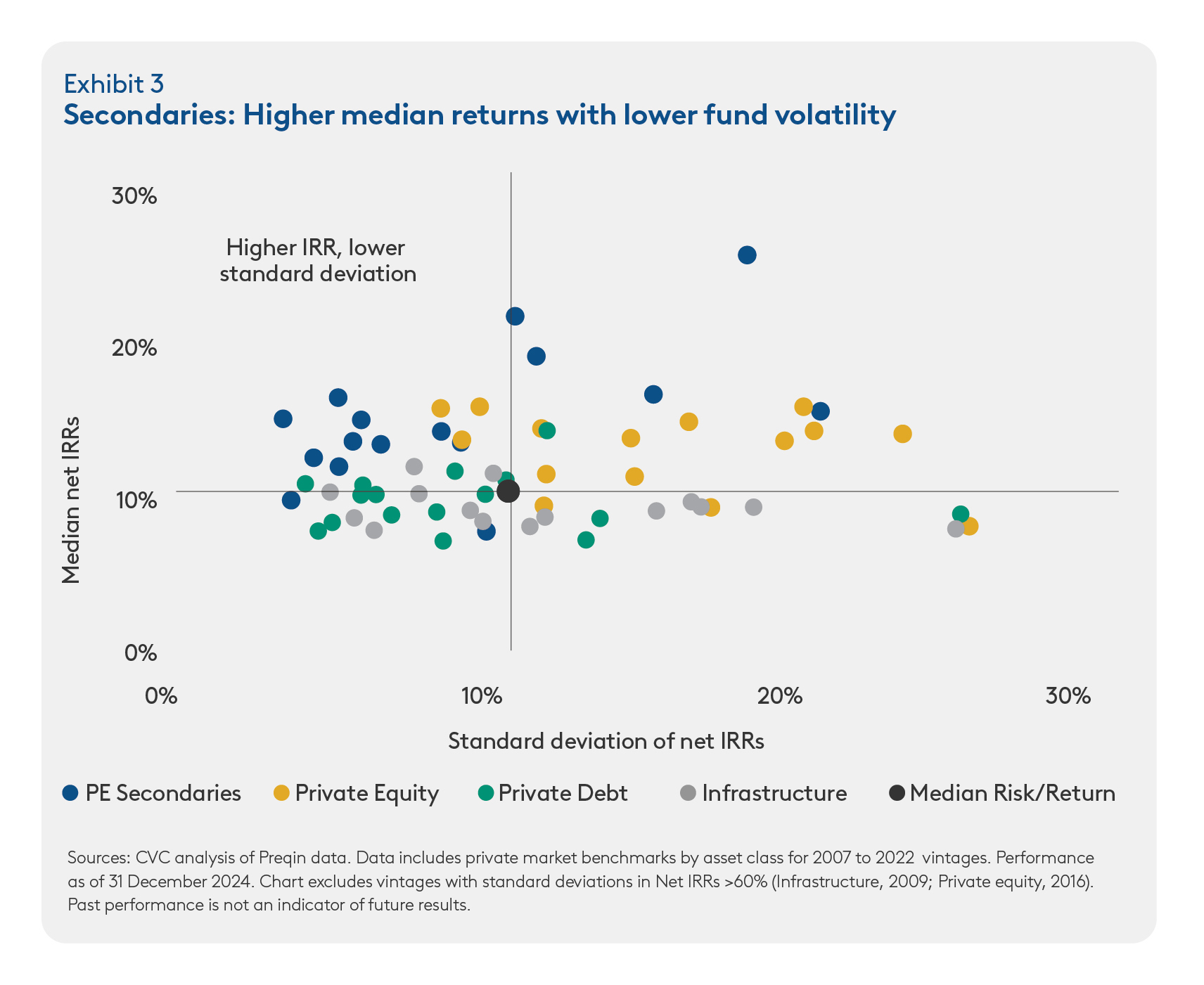

Historically, secondary vintages have delivered higher median returns than other private-markets strategies, with significantly lower dispersion across funds’ net IRRs (Exhibit 3).

Much of that stability stems from the very architecture of the asset class. Features such as accelerated distributions, informational advantages that tilt selection toward stronger assets and managers, as well as diversification across seasoned, partially de-risked holdings act as natural stabilisers.

The rise of GP-led transactions

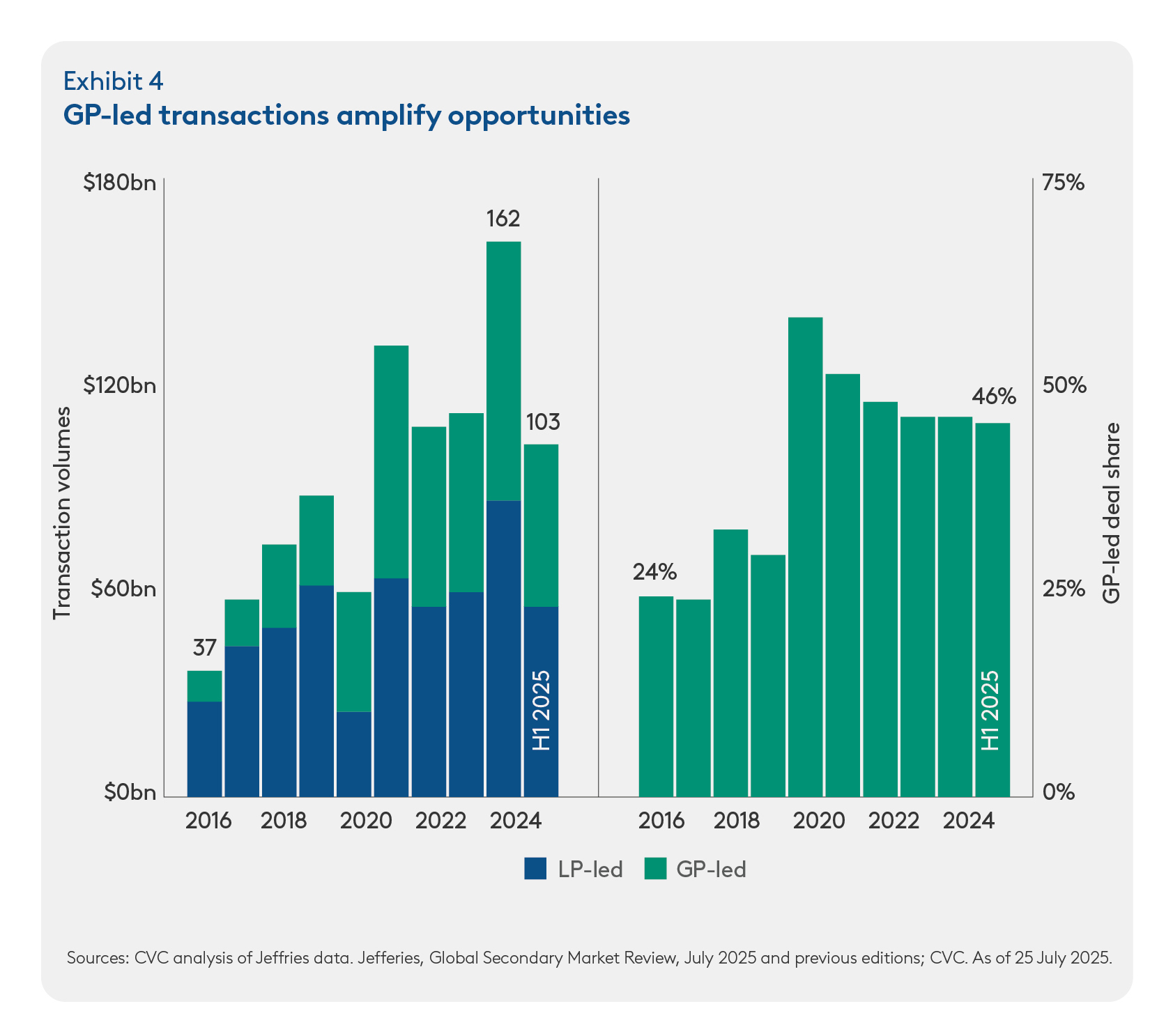

Within the secondaries market, GP-led transactions have expanded over recent years, growing from 24% of volumes in 2012 to nearly half today (Exhibit 4). Their rapid growth reflects strong buyer demand and their increased use by sponsors, with rising numbers of leading GPs bringing higher-quality assets to market.

At a time when IPOs, strategic trade and sponsor-to-sponsor exits have become more constrained, GP-led deals are providing managers with valuable realisation optionality.

However, their rapid adoption also points to a broader structural evolution, with GP-led deals now serving as a routine mechanism for extending ownership and optimising investment outcomes. These transactions allow GPs to realise further value creation potential by lengthening investment horizons of their best assets and avoiding selling to a competitor.

This shift has made single- and multi-asset transactions a defining feature of today’s opportunity set. Three-quarters of leading GPs have now completed deals, and transaction sizes are trending larger.2 Continuation vehicles, in particular, have emerged as the structure of choice, offering sponsors flexibility to extend ownership of prized companies, rebalance portfolios and deliver interim liquidity to LPs.

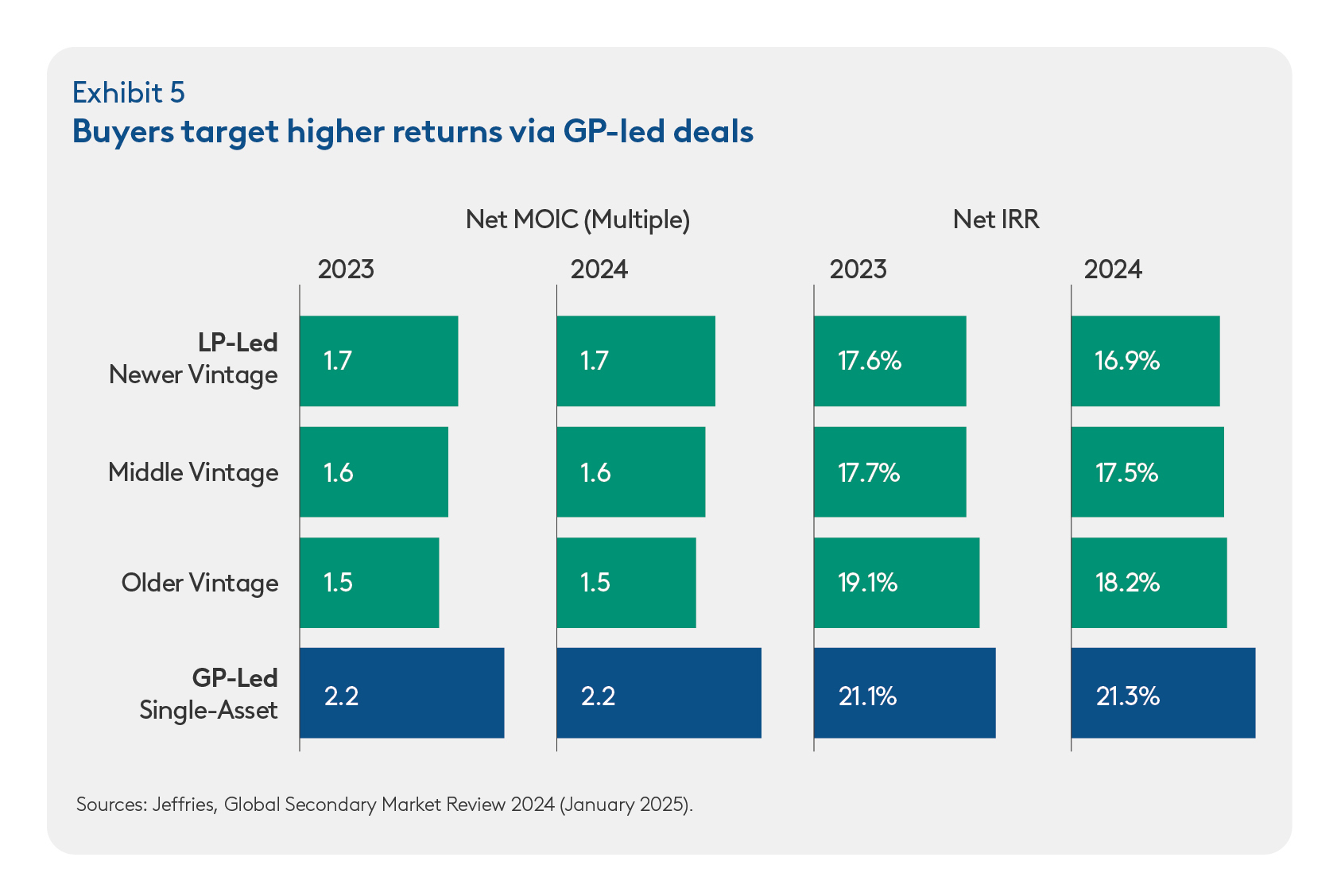

For investors, the transactions represent a compelling opportunity within the secondaries market, they provide investors with concentrated stakes in seasoned assets managed by top-tier sponsors. The growing interest in the market is therefore unsurprising. A recent survey indicates that investors now target higher returns from GP-led single-asset transactions (Exhibit 5), underscoring why these are among the most sought-after deals in the secondaries market.

Conclusion

Secondaries have become a core component of a private-markets allocation, powered by structural demand and enabled by an innovative and dynamic marketplace more than two decades in the making.

Their enduring appeal lies not in cyclical dynamics, but in a durable set of advantages that continue to resonate with investors. This includes a unique combination of strategic flexibility, accelerated distributions, enhanced access and selectivity, consistent returns and the maturing GP-led market.

Record deployment testifies to their growing centrality. With investors requiring greater flexibility, liquidity visibility and diversification, secondaries are playing an increasingly integral role in modern portfolio strategies.

Important Notice to Recipients:

This confidential document (this “Confidential Document”) is being communicated to a limited number of sophisticated persons (each, a “Recipient”) by CVC, as defined below for information purposes only. THIS CONFIDENTIAL DOCUMENT IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION AND MAY NOT BE USED FOR AND DOES NOT CONSTITUTE AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO SUBSCRIBE FOR OR PURCHASE ANY INTERESTS OR TO ENGAGE IN ANY OTHER TRANSACTION.

Nothing contained herein shall be deemed to be binding against, or to create any obligations or commitment on the part of, the addressee nor any of CVC Capital Partners plc, Clear Vision Capital Fund SICAV-FIS S.A, each of their respective successors or assigns and any form of entity which is controlled by, or under common control with CVC Capital Partners plc or Clear Vision Capital Fund SICAV-FIS S.A. (from time to time the “CVC Entities“ or “CVC” and each a “CVC Entity”). For the purpose of the foregoing definitions, control includes the power to (directly or indirectly and whether alone or with others) appoint or remove a majority of an entity’s directors or its general partner, manager, adviser, trustee, founder, guardian, beneficiary or other management officeholder) and controlled and controlling shall be interpreted accordingly. No CVC Entity undertakes to provide the addressee with access to any additional information or to update this Confidential Document or to correct any inaccuracies herein which may become apparent. This Confidential Document is not intended for distribution, and shall not be distributed, in any jurisdiction where such distribution would violate applicable securities laws.

Certain information contained herein (including certain forward-looking statements, financial, economic and market information) has been obtained from a number of published and non-published sources prepared by other parties and companies, which may not have been verified and in certain cases has not been updated through the date hereof. While such information from other parties and companies is believed to be reliable for the purpose used herein, no member of CVC, any of their respective affiliates or any of their respective directors, officers, employees, members, partners or shareholders assumes any responsibility for the accuracy or completeness of such information. Certain economic, financial, market and other data and statistics produced by governmental agencies or other sources set forth herein or upon which the CVC’ analysis and decisions rely may prove inaccurate.

Nothing contained herein shall constitute any assurance, representation or warranty and no responsibility or liability is accepted by CVC or its affiliates as to the accuracy or completeness of any information supplied herein or any assumptions on which such information is based. Further, this Confidential Document reflects only the views of CVC with respect to private equity markets and other market participants may hold different views or opinions. Accordingly, each Recipient should conduct their own independent due diligence and not rely on any statement or opinion offered herein.

In addition, no responsibility or liability or duty of care is or will be accepted by CVC or its respective affiliates, advisers, directors, employees or agents for updating this Confidential Document (or any additional information), or providing any additional information to you.

Accordingly, to the fullest extent possible and subject to applicable law, none of CVC or its affiliates and their respective shareholders, advisers, agents, directors, officers, partners, members and employees shall be liable (save in the case of fraud) for any loss (whether direct, indirect or consequential), damage, cost or expense suffered or incurred by any person as a result of relying on any statement in, or omission from, this Confidential Document.

1 Jefferies, Global Secondary Market Review, July 2025.

2 Jefferies, Global Secondary Market Review, July 2025.