Alternative Credit Solutions for Insurers

Alternative credit encompasses a broad spectrum of strategies – including IG private corporates, infrastructure debt, collateralised loan obligations (CLOs), asset-based finance (ABF), leveraged loans, direct lending and capital solutions. These strategies may enable insurers to earn attractive additional returns in an environment where public markets are defined by persistent rate uncertainty, tight credit spreads and elevated volatility.

Key Takeaways

Across liability-matching and return-seeking allocations alike, alternative credit provides insurers with a scalable, capital-efficient pathway to enhance yield, strengthen portfolio resilience and capture long-term value creation.

- Harvesting spread advantage with resilience:

Private and structured credit strategies provide meaningful spread pick-up over public markets while maintaining defensive credit characteristics. - Enhancing capital efficiency:

Across solvency regimes – including Solvency II, US RBC, BSCR, and ICS – private credit strategies may offer favourable capital treatment, improving return-on-capital outcomes. - Supporting ALM and liquidity needs:

From long-dated private debt and ABF to CLOs, liquid leveraged loans and evergreen credit vehicles, alternative credit provides insurers with a flexible menu of options to balance duration, yield and liquidity. - Europe rising:

Europe has become a compelling landscape for private credit investments, with structurally wider spreads, stronger covenants and lower leverage than the U.S. – advantages reinforced by market fragmentation that rewards local expertise. - Innovation through capital solutions:

Subordinated private corporate debt and bespoke financing structures are filling the gap between senior debt and equity, offering insurers the potential for equity-like returns with fixed-income risk.

Navigating the Allocation Dilemma

Introduction

Insurers have traditionally invested in high quality government and public corporate bonds to meet their asset and liability management objectives. However, the current market environment – characterised by slower-than-expected rate cuts, compressed spreads and heightened equity market volatility – has challenged the effectiveness of conventional strategic asset allocation.

At the same time however, structural shifts in global credit markets have opened new avenues for investment. The evolution of the private credit universe, encompassing private IG placements, private ABF, middle-market corporate direct lending and capital solutions, now grants insurers access to differentiated credit exposures that combine attractive spread pick-up with enhanced structural protection.

As banks pivot towards capital-light activities under Basel III, insurers are increasingly stepping in as long-term, stable capital providers. Regulators now recognise this important role insurers play in supporting real-economy growth through lending from their long term balance sheets.

In parallel, the growing complexity of insurance products, such as with-profit and unit-linked offerings, also demands greater adaptability and innovation in portfolio construction. In this context, alternative credit has become an essential building block for delivering superior risk-adjusted yields, broader diversification and improved capital efficiency alongside traditional public fixed income and equity holdings.

Alternative Credit Spectrum

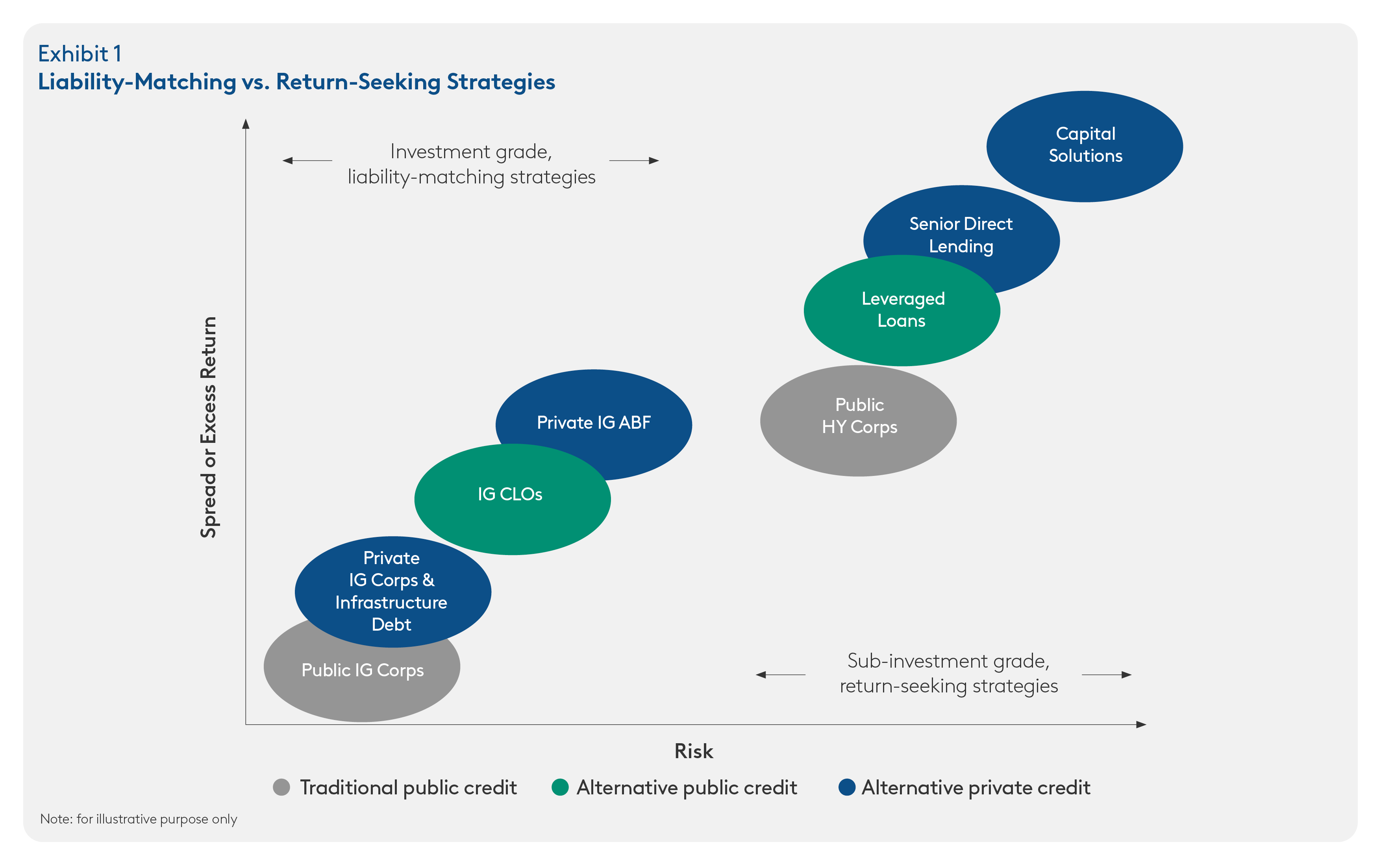

Alternative credit spans a broad array of public and private market strategies (Exhibit 1). With respect to insurers’ balance sheets, these strategies can be broadly grouped into:

- Investment grade, liability-matching strategies such as IG private corporate debt, infrastructure debt, IG CLOs, and private IG ABF, which offer predictable cash flows and attractive illiquidity or complexity premia.

- Sub-investment grade, return-seeking strategies such as broadly syndicated leveraged loans, senior direct lending and capital solutions (flexible forms of junior and hybrid capital), which provide enhanced spreads, portfolio diversification and a natural hedge against rising rates.

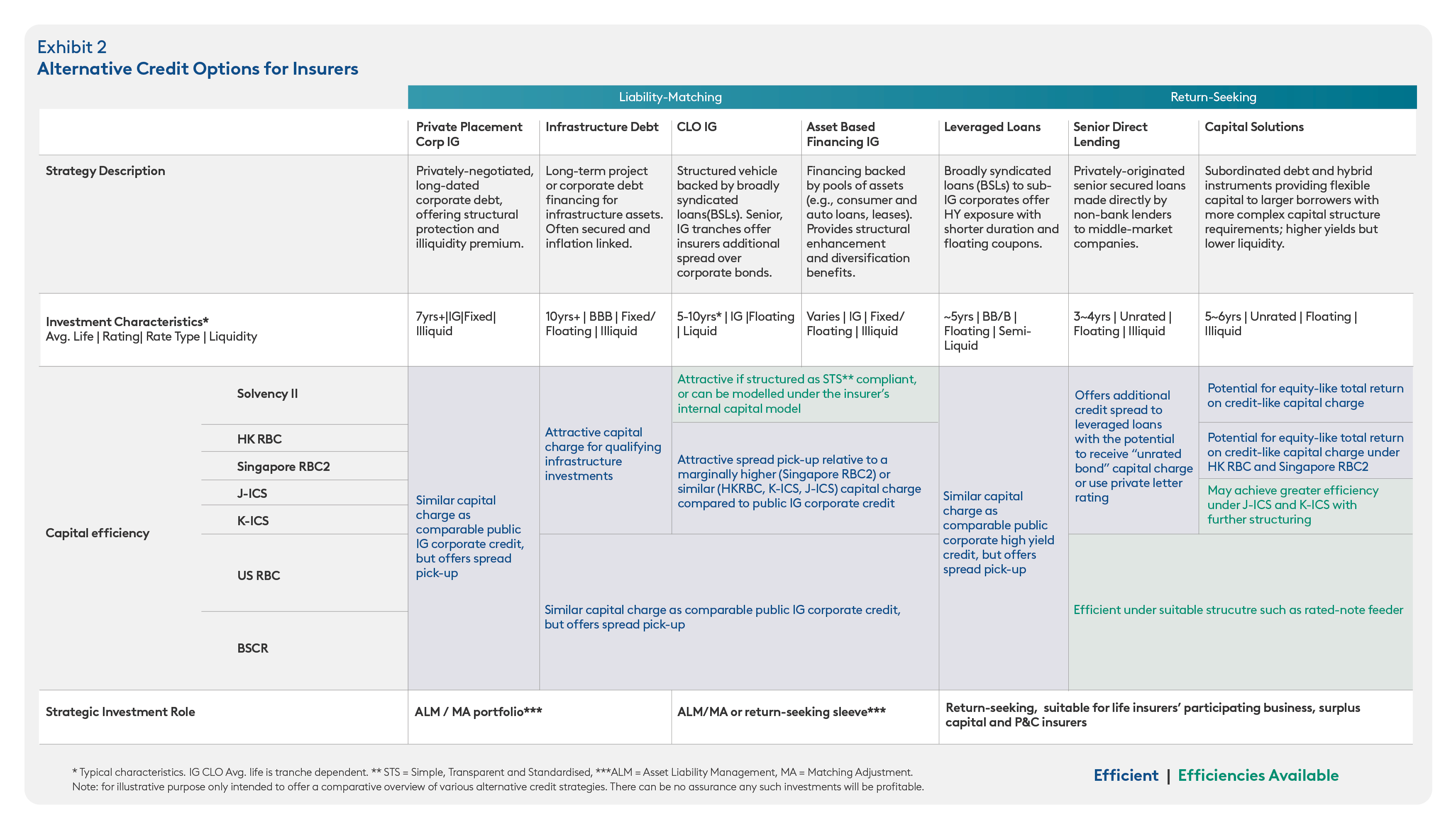

The table below provides a comparative overview of major alternative credit strategies used by insurers.

The Strategic Value of Alternative Credit

1. Enhanced returns and spreads

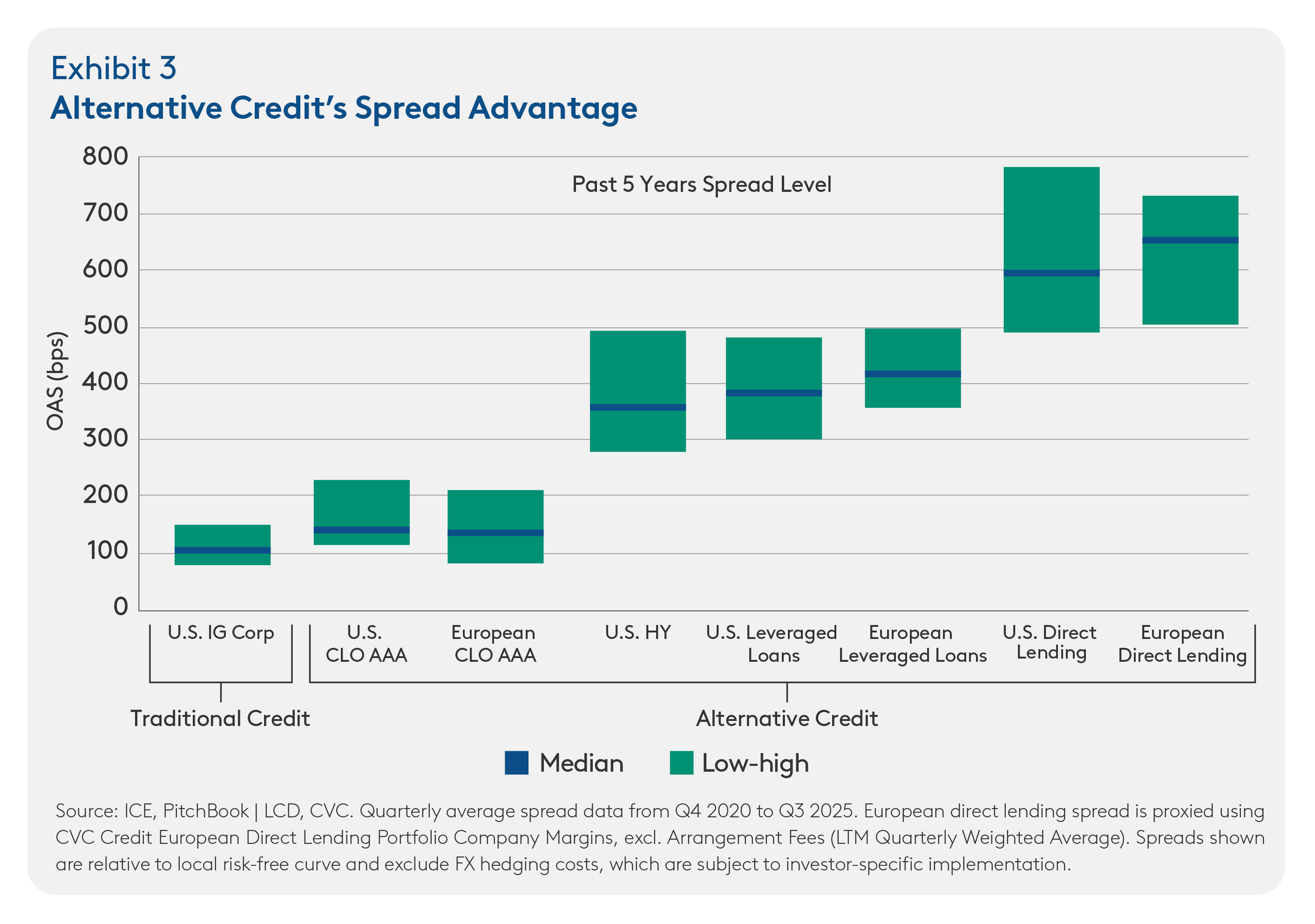

Challenge: Securing incremental yield within a constrained credit risk budget.

Solution: Reallocate traditional return-seeking exposures – such as high yield or distressed debt – toward leveraged loans, CLOs and private credit to achieve superior risk-adjusted returns.

Strategic benefit: With public credit spreads near 15-year lows, alternative credit strategies may offer an attractive way to enhance portfolio returns through complexity and the illiquidity risk premium, while potentially benefitting from embedded structural risk mitigants. These benefits may help deliver enhanced returns without requiring investors to add incremental risk exposure by travelling down the credit quality curve.

From 2015 to 2024, leveraged loans exhibited average annual default rates of just 1.7% in the U.S. and 1.8% in Europe, compared with 3.6% for U.S. sub-investment-grade corporate bonds and 2.8% for their European counterparts.1 This difference underscores the stronger creditor protections embedded in leveraged loans, including their senior-secured position and tighter covenants.

Direct lending further enhances risk controls and credit selectivity through bespoke deal structuring, customised documentation and active monitoring, while CLOs deliver portfolio-level diversification by holding 150–250 broadly syndicated loans across sectors to reduce idiosyncratic risk, combined with active portfolio management and a resilient, time-tested structure. The floating-rate nature of these assets also enhances portfolio resilience during interest rate hiking cycles.

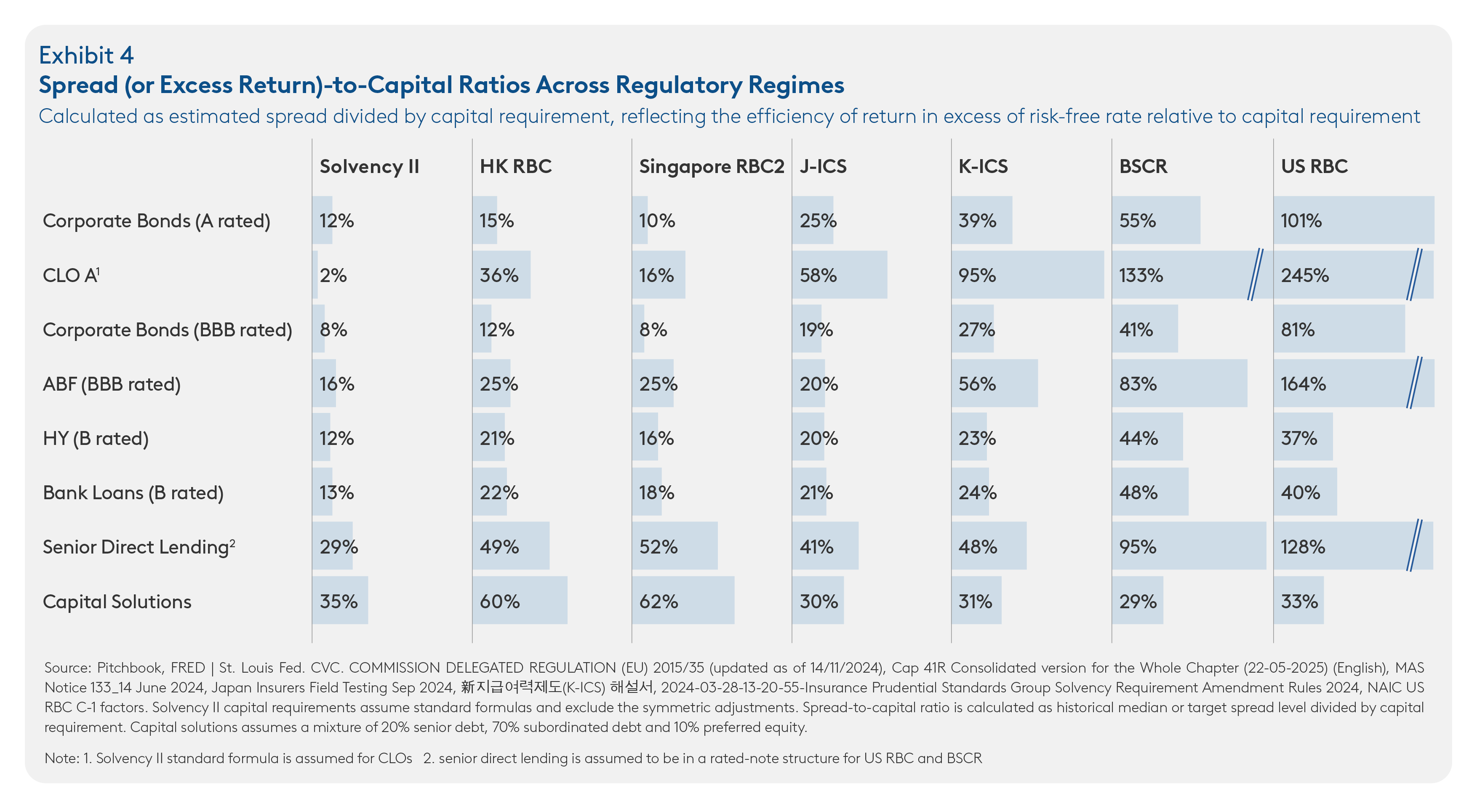

2. Improved capital efficiency

Challenge: Managing capital requirements amid evolving regulatory frameworks, particularly for Asian and European insurers.

Solution: Adopt capital-efficient structures and allocate to asset classes offering superior capital-adjusted returns, tailored to the jurisdiction-specific regulatory regimes.

Strategic benefit: Strengthened capital productivity and investment flexibility allows insurers to unlock new sources of yield while maintaining robust solvency positions.

Regulatory watchlist: key developments

U.S.: CLOs currently receive bond-equivalent capital treatment and offer significantly higher yields. The National Association of Insurance Commissioners (NAIC) is reviewing capital charges, with adjustments expected to focus on mezzanine tranches with limited impact on senior exposures.

Europe: CLO allocations have remained modest due to Solvency II’s conservative framework for securitised assets. However, proposals to reduce capital charges for qualifying CLOs were included in a consultation paper published by the European Insurance and Occupational Pensions Authority (EIOPA) in July 2025, creating potential for increases in insurer participation.

Asia: regulators are also recognising the role of private credit in long-term financing – infrastructure debt may benefit from favourable treatment under evolving regimes such as Singapore’s RBC2 framework, which is considering capital relief for qualifying projects with stable cash flows.

3. Optimal ALM management (Life Insurers)

Challenge: Maintaining alignment between asset and liability cash flows while achieving attractive yields.

Solution: Allocate to long-term private assets or structured credit to capture the illiquidity premium and improve asset-liability matching.

Strategic benefit: Life insurers, particularly annuity writers, are fundamentally credit spread investors – seeking to harvest the differential between asset yields and the crediting rate to their policyholders. Allocations to IG private credit may deliver higher spreads than public corporates while maintaining long-duration, fixed or highly predictable cash flows.

In the U.S., insurers have steadily expanded their allocations to privately placed bonds, rising from around 29% of total bond holdings in 2015 to roughly 46% in 2024,2 reflecting the attractiveness of higher spreads and better duration matching.

For UK pension risk transfer (PRT) writers, long-duration, high quality private placements, including infrastructure project debt and private ABF, are increasingly integral to matching adjustment portfolios. These assets leverage the illiquidity premium to enhance portfolio returns while matching cash flow requirements. Select CLO structures – such as middle-market transactions or large original-issue-discount tranches – can also serve as effective liability-matching instruments, offering more predictable prepayment behaviour and enhanced yield efficiency.

4. Alpha embedded liquid solutions (P&C Insurers & Unit-linked products)

Challenge: Enhancing yield while preserving liquidity.

Solution: Allocate to leveraged loans, CLOs, or evergreen private credit vehicles that offer flexible entry and redemption mechanisms.

Strategic benefit: For P&C and unit-linked portfolios, liquid leveraged loans and CLOs can serve as effective “parking” vehicles – delivering immediate exposure to income-generating assets. These instruments preserve insurers’ liquidity and ability for timing capital redeployment toward less liquid private credit opportunities.

Evergreen structures are becoming an increasingly popular vehicle for insurers to access private markets. They combine several desirable features and benefits – such as potential for J-curve mitigation, faster capital deployment, immediate yield generation and periodic liquidity – within an operationally efficient framework.

CVC Credit Solutions

CVC Global Yield Fund or SMAs:

- Core focus on global bank loans

- Income and potential for downside protections

- Quarterly distributions and monthly liquidity

- Rapid capital deployment compared to drawdown structures

CVC-CRED (Evergreen):

- Access to private credit platform

- Attractive cash yield

- Monthly NAV valuation, monthly distributions, and quarterly redemption up to 5% of NAV

- Immediate portfolio exposure

Emerging Opportunities in Alternative Credit

1. Europe Rising

In 2025, the private credit market focus has shifted from “if” to “where.” While the U.S. remains the largest and most mature market, Europe has emerged as a compelling landscape for growth and diversification.

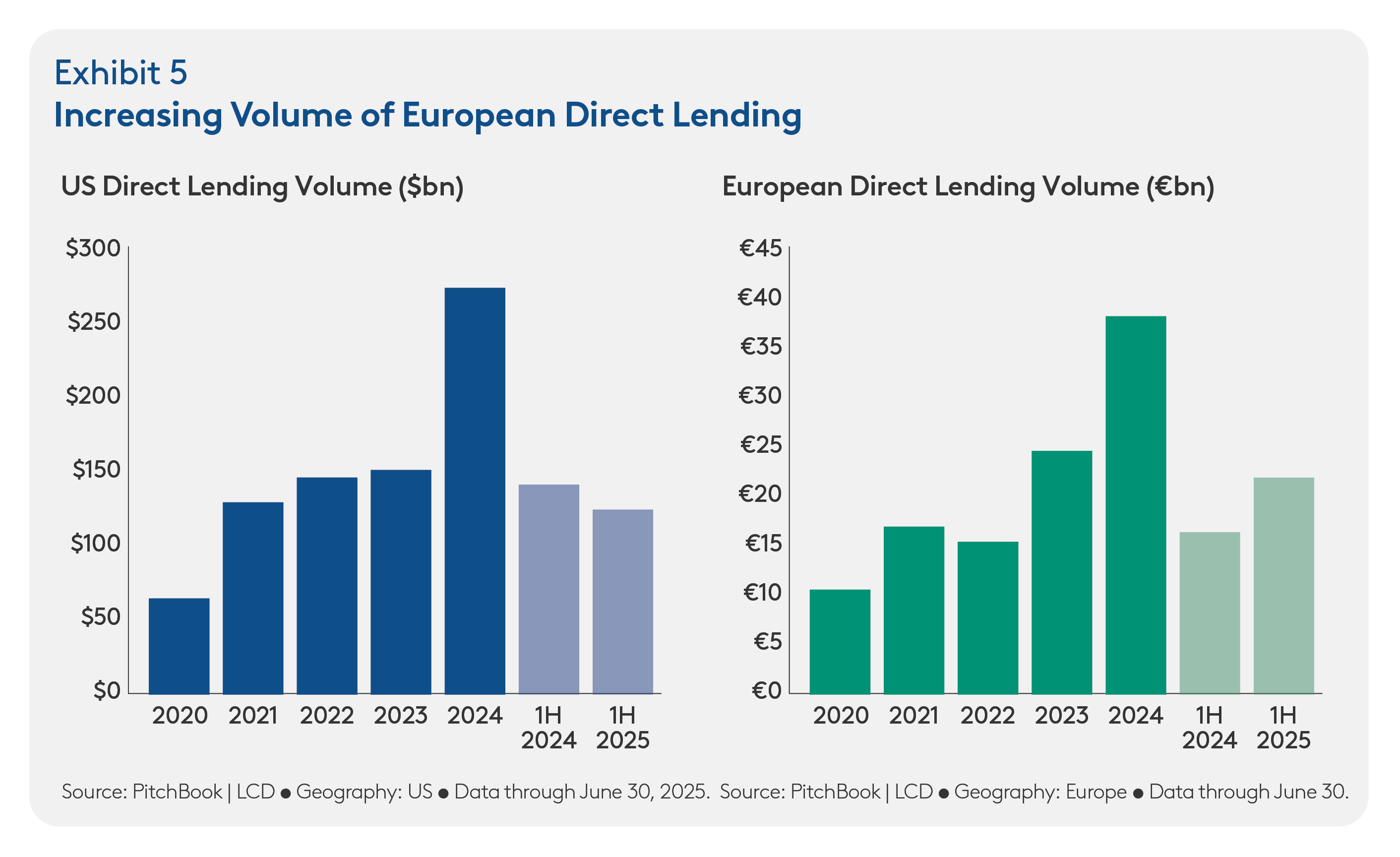

European direct lending volumes in 1H 2025 are well above the same period last year (Exhibit 5) as bank lending amid retrenches under tighter Basel III/IV capital constraints.

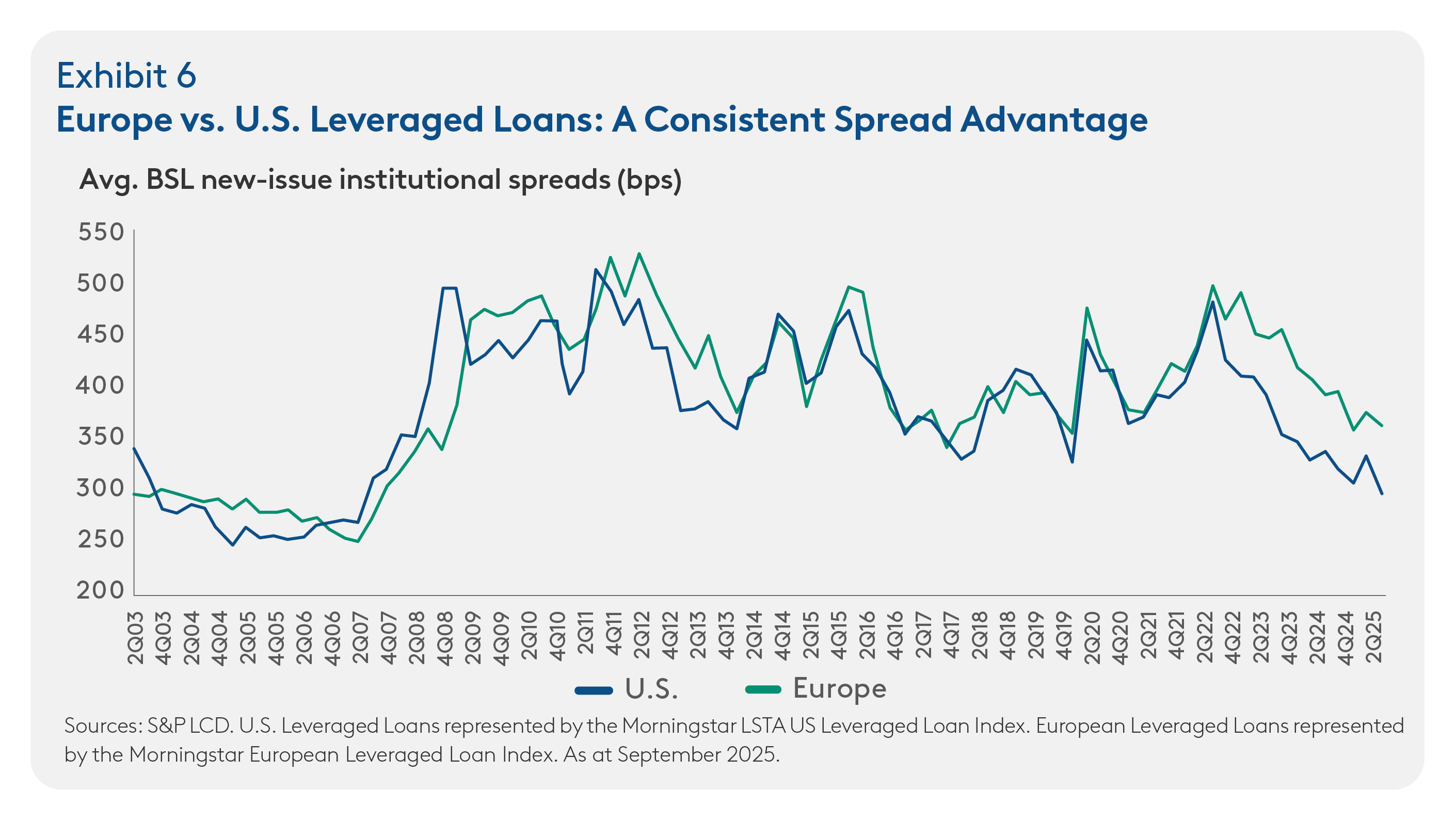

Europe’s appeal lies in its structural yield premium and potential for enhanced downside protection through typically more robust documentation compared to U.S. direct lending. Since 2017, European leveraged loans have consistently traded at a spread advantage of roughly 50 bps over U.S. peers (Exhibit 6), a premium that also exists in the direct lending market. This premium reflects the region’s fragmented market structure – spanning across 18 countries, 8 currencies, 54 official languages and multiple regulatory regimes – which naturally limits competition and rewards managers with deep local networks.

Moreover, European leveraged buyouts (LBOs) typically exhibit higher interest coverage and lower leverage than those in the U.S., highlighting the region’s more conservative underwriting standards and disciplined sponsor behaviour. These characteristics have historically contributed to lower credit loss and greater resilience across credit cycles.

Europe’s fragmentation, often perceived as a barrier, is, in fact, the region’s enduring edge. A complex mosaic of legal, linguistic and regulatory environments reduces the number of effective lenders.

For specialist managers, this translates into greater pricing power, tighter covenants and stronger structural protections – a combination historically delivering superior risk-adjusted returns. However, Europe’s complexity also amplifies performance dispersion, making manager selection a critical success factor.

2. Evolution of Capital Solutions

Over the past decade, demand has steadily risen for capital solutions that address special borrower situations and needs – from financing M&A and refinancing debt to raising non-dilutive equity or securing capital in volatile markets.

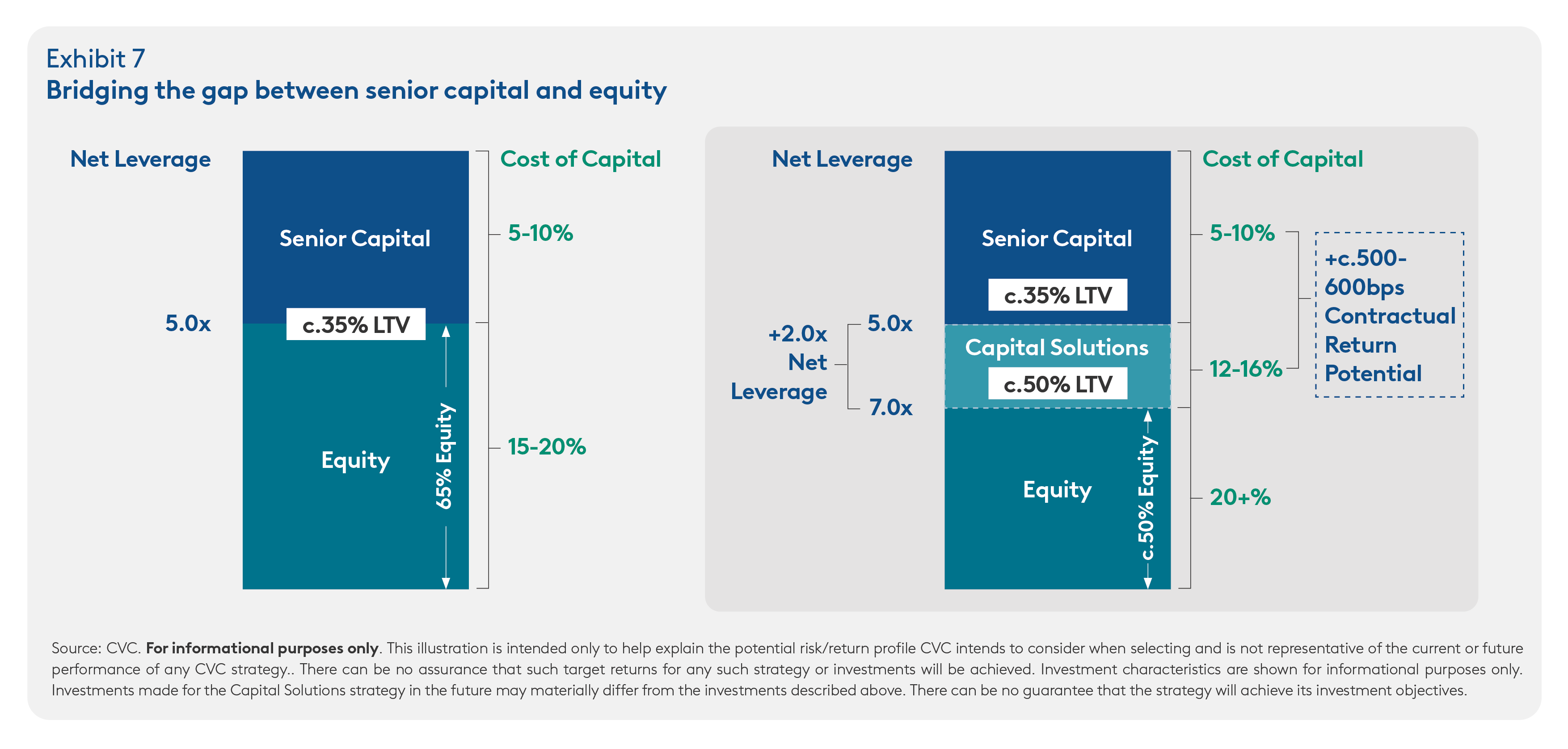

In this environment, CVC’s capital solutions strategy focuses on flexible forms of junior and hybrid capital – such as second lien debt, payment-in-kind (PIK) loans and preferred equity – that are increasingly used to bridge the gap between senior leverage and sponsor equity. These structures offer tailored financing to support high-quality companies (often sponsor-backed) in their strategic and growth aims.

For insurers, CVC’s capital solutions have the potential to offer equity-like returns with fixed-income risk. Although junior capital tends to attract higher capital charges under Solvency II and other solvency frameworks, the return per unit of capital deployed remains compelling – particularly for insurers not tightly constrained by capital budgets or seeking to optimise overall portfolio return-on-capital.

CVC’s capital solutions transactions are underpinned by robust structural protections, including significant equity cushions (often 50% or more), conservative loan-to-value ratios and lending to borrowers with proven, non-cyclical business models. The result is an asset class that combines attractive income potential with downside resilience, providing a compelling addition to insurers’ menu of return-seeking allocations.

Conclusion

Alternative credit is rapidly becoming an important solution within insurers’ portfolios, bridging the divide between traditional public credit and private markets. Across the spectrum – from liability-matching private placements to return-seeking direct lending and capital solutions – these assets offer enhanced spreads, stronger structural protection and improved capital efficiency.

As regulatory frameworks evolve and the European private credit market continues to develop, alternative credit is poised to remain a core component of insurers’ strategic asset allocation strategies. By blending financial resilience, diversification and the potential for long-term value creation, alternative credit becomes a powerful tool for portfolio efficiency and navigating market cycles.

Disclosure:

Nothing in this publication constitutes a valuation or investment judgment regarding any specific financial instrument, issuer, security, or sector mentioned or referenced herein. The content presented does not represent a formal or official view of CVC and is not intended to relate specifically to any investment strategy, vehicle, or product offered by CVC.

This publication is provided solely for informational purposes and is intended to serve as a conceptual framework to support investors

in conducting their own analysis and forming their own views on the subject matter discussed.

No assurance can be given that any investment strategy discussed will be successful. Past market trends are not reliable indicators of future performance, and actual outcomes may vary significantly. The information, including any commentary on financial markets, is

based on current market conditions, which are subject to change and may be superseded by subsequent events.

Performance data for any referenced indices is shown on a total return basis, with dividends reinvested. Such indices are unmanaged, do not include fees, expenses, or charges, and are not available for direct investment.

1 Pitchbook Leveraged Loan Index Factsheet, S&P 2024 Annual Global Corporate Default And Rating Transition Study

2 NAIC, S&P Global insurance industry analysis