By proactively managing material climate change risks and opportunities, both physical and transition, we seek to create long-term value for our investments and stakeholders. CVC continues to evolve its understanding of climate risks both in our own operations and in our portfolio.

CVC is committed to helping accelerate the energy transition and proactively managing the impacts of this on our portfolio. We believe that reducing our own GHG emissions footprint and engaging with the portfolio to do the same, is not only the right thing to do for society and the planet, but that it also creates long-term value for our companies and stakeholders.

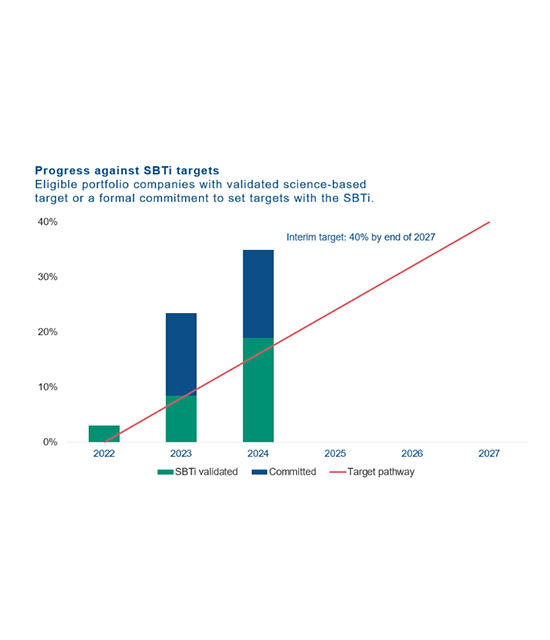

Science Based Targets initiative (SBTi)

CVC has publicly set greenhouse gas (GHG) emissions reductions targets with the Science Based Targets initiative (SBTi). This target was approved by the Board of CVC and has been validated by the SBTi.

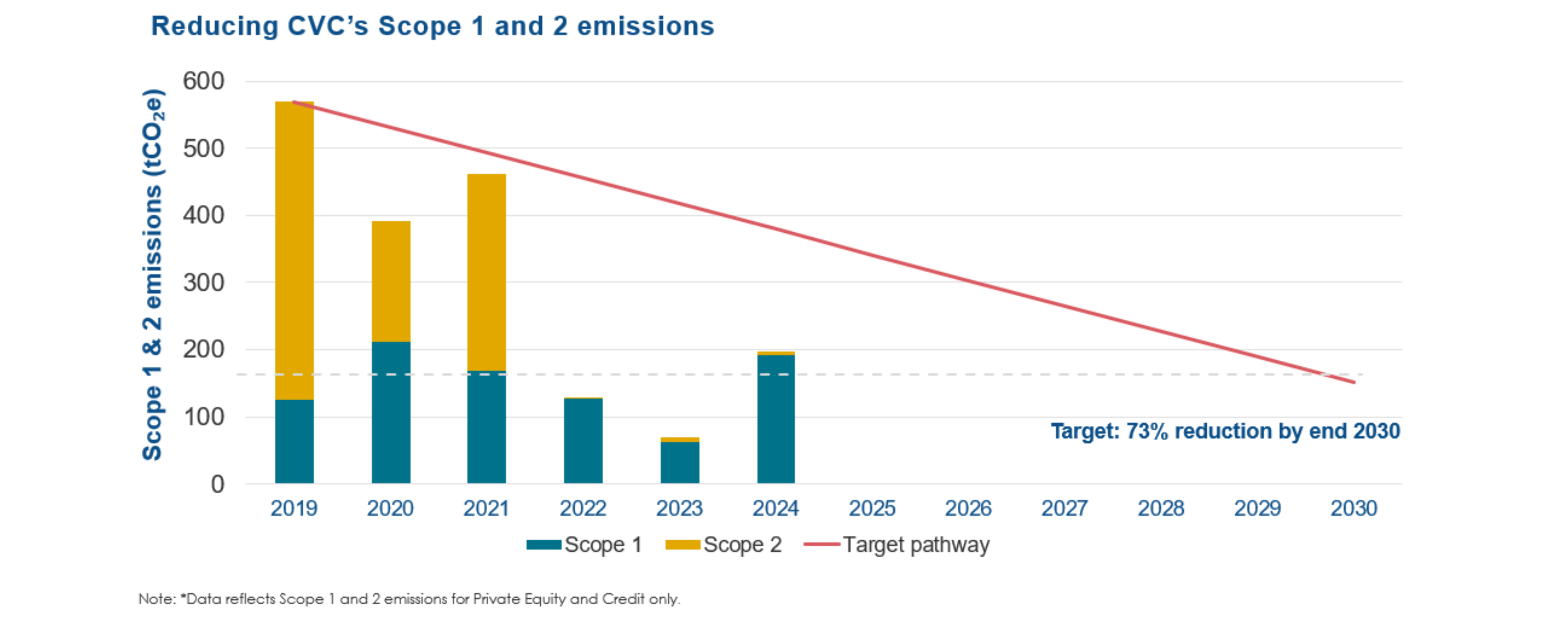

Scope 1 and 2: CVC commits to reduce absolute Scope 1 and 2 GHG emissions by 73% by 2030 from a 2019 base year.

Scope 3 Portfolio Targets: CVC commits to 40% of its eligible private equity and listed equity investments by invested capital setting SBTi validated targets by 2027, and 100% of its eligible private equity and listed equity investments by invested capital setting SBTi validated targets by 2035.

Operational emissions

Our direct and indirect operational emissions (Scope 1 and 2) are predominantly result of the running of our offices. We aim to reduce these emissions by:

- Purchasing renewable energy

- Electrifying our vehicle fleet

- Considering energy efficiency in new leases

By purchasing renewable electricity, we have significantly reduced our Scope 2 emissions and plan to do the same in future years.

The increase in Scope 1 and 2 emissions in 2024 is primarily due to the inclusion of refrigerant-related emissions, improving the completeness and accuracy of our data.

Portfolio emissions

Emissions from our investment portfolio (Scope 3, Category 15) account for the vast majority of our GHG emissions footprint. We are therefore prioritising the decarbonisation of our portfolio, with a particular focus on our PE and infrastructure portfolios, where we have the most influence to effect change. In our role as manager and adviser to the funds’ investment portfolios, we encourage investee companies to improve the quality and accuracy of the climate data they report and set decarbonisation targets where relevant, and where there is the opportunity to do so.

CVC Planet and People Grants

We award People and Planet Grants to CVC's portfolio companies to accelerate progress on projects that have positive social and environmental impacts.

During the programme, our portfolio companies gain insights that they can share across the network to widen the reach of the projects.