CVC – Your Premier Evergreen Private Credit Partner in Europe

An increasing number of eligible investors are seeking flexible access to Europe’s private credit market. The market is fast growing, offers attractive spreads and stronger downside protection when compared to the equivalent market in the United States.1

CVC combines its extensive local network, experienced investment team and proven track record in credit investing, to offer investors CVC-CRED.

As an evergreen Fund, CVC-CRED benefits from CVC’s institutional credit platform and gives eligible investors access to not only European private credit, but also consistent performance, and greater flexibility in one simplified structure.

CVC-CRED: Designed for Investors

CVC-CRED gives investors access to CVC’s European sourcing network and investment platform, proven across multiple cycles.

With more than 40 years of investing heritage in Europe, and backed by seasoned investment professionals on the ground, the platform has the scale and experience to deliver with consistency.

The Fund is structured to simplify the investor experience:

- Immediate deployment - access to a seeded portfolio of privately negotiated European loans, aiming to generate returns from day one.

- Operational ease - no repeated capital calls, recommitments, or reinvestment planning.

- Flexibility - ongoing control through the ability to add capital monthly and request redemptions quarterly.

- Income or accumulation - share class options tailored for compounding growth or income generation, depending on investor objectives.

What sets CVC-CRED apart is its strength in origination. As part of the institutional CVC Credit platform, the Fund draws on the full reach of the CVC Network.

This translates into local teams deeply embedded in their markets, building strong relationships and applying disciplined underwriting.

They combine credit and sector knowledge, with further unique insights through CVC’s Private Equity platform.

The result is access to high quality opportunities that are often less visible to the wider market, giving CVC-CRED investors a distinct advantage in European private credit.

CVC Network: Our Origination Advantage

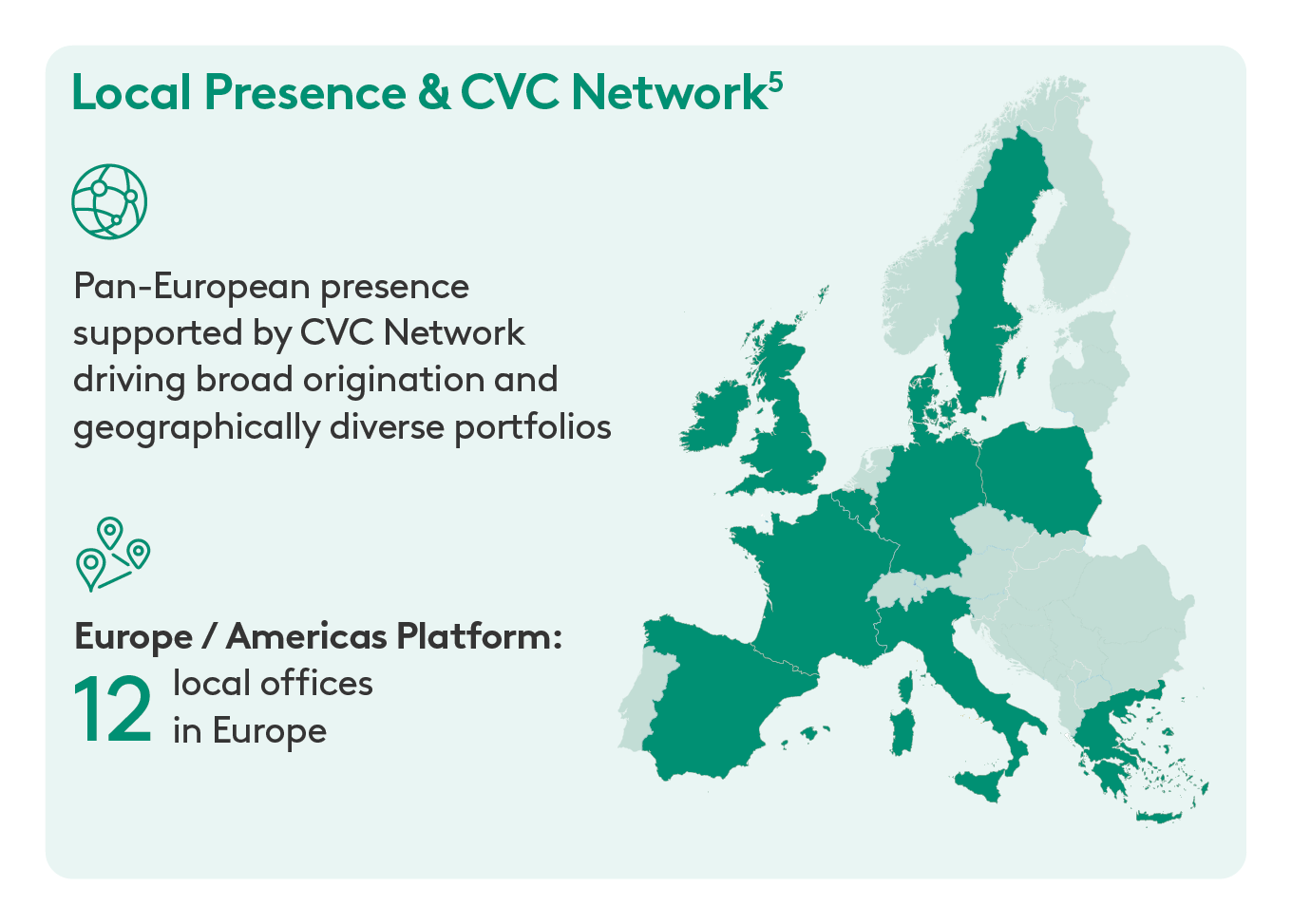

CVC operates 12 local offices across Europe, each working seamlessly with CVC’s broader global Network of 30 offices.

With over 500 highly experienced professionals embedded locally, we operate one of the most comprehensive origination platforms in the market today.

This local “on the ground” presence provides detailed insights into country and sector dynamics through different cycles.

It also enables us to build long-standing relationships with high quality corporate management teams, deal intermediaries and sponsors, who often prefer bilateral discussions in their own language.

For illustrative purposes only. All information as of 30 June 2025 unless otherwise noted. All interaction and collaboration with CVC Capital Partners is subject to the Firm’s Information Barrier Policies & Procedures and Compliance approval. There is no guarantee that the team will be able to leverage CVC Capital Partners expertise and network on any future investment opportunity. 1. As at 30 June 2025, includes the CVC Private Credit and Liquid Credit teams. 2. CVC Credit has a local presence in New York, London, Paris, Milan, Frankfurt and Belgium. Simone Zacchi is based in London and spends a portion of his time in Milan performing activities related to deal sourcing. 3. CVC Credit’s Direct Lending track record has zero realised losses. 4. Refers to CVC’s Private Equity business.

Additionally, our CVC Credit team has differentiated insights via the CVC Private Equity platform, drawing on detailed due diligence and deal pipeline visibility, to gain an informational edge.

This provides privileged access to local sector knowledge, management teams and senior business executives, strengthening access, credit analysis and execution.

The partnership underlines CVC’s collaborative, entrepreneurial spirit, with appropriate incentives aligning investment professionals across the CVC Network.

Together, these advantages translate into high-quality proprietary deal flow for our Investment Committee, allowing them to remain highly selective while securing resilient documentation and strong yields.

In evergreen investing, where long term partnerships and consistent reinvestment are essential, CVC’s embedded local expertise, amplified by the scale and connectivity of the CVC Network, gives investors a decisive edge in European private credit.

CVC-CRED: Built for Performance

This origination strength is matched by disciplined portfolio management. Selection is only the beginning, as CVC-CRED’s experienced team applies rigorous oversight to protect capital and maintain resilience through cycles.

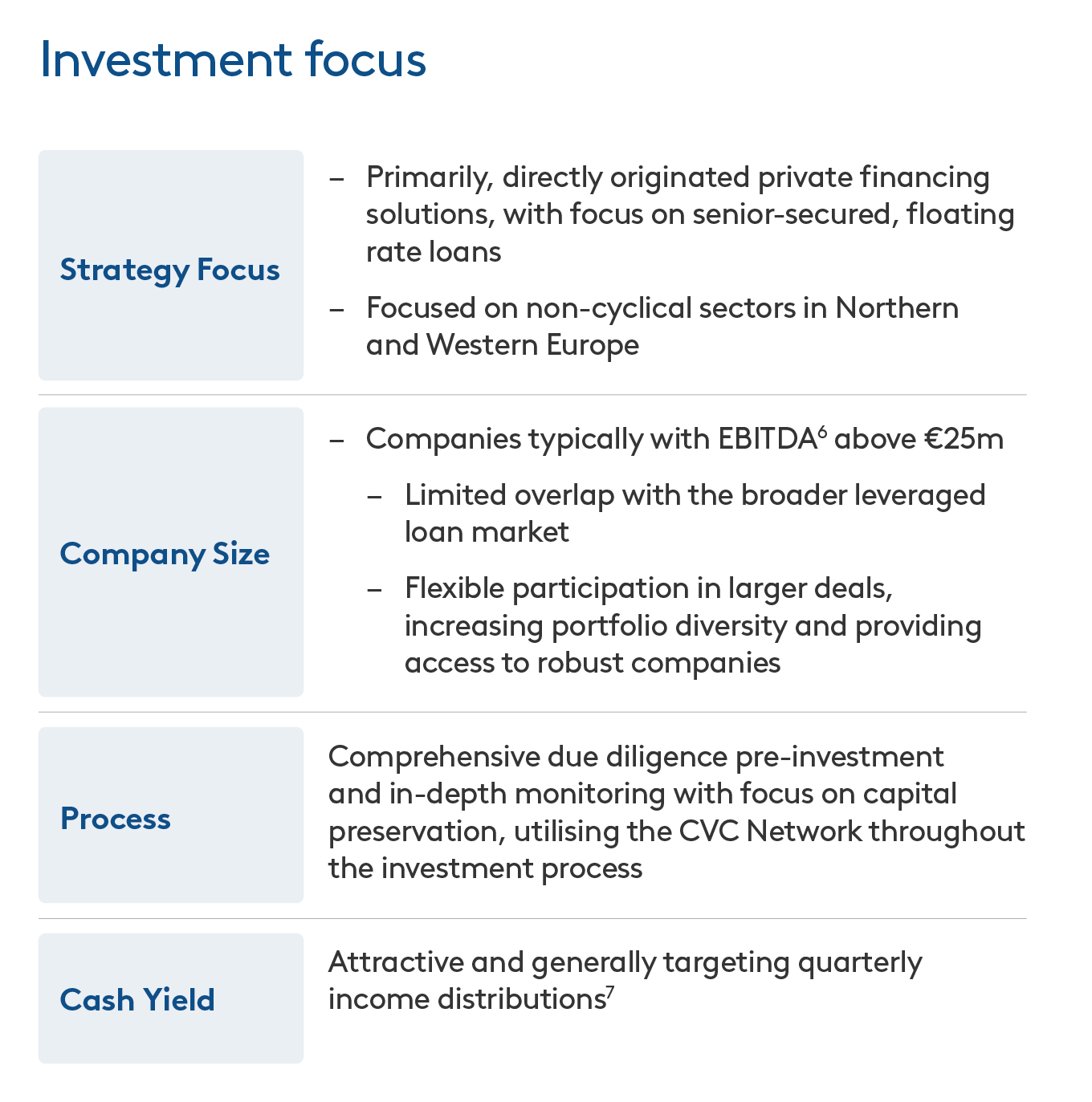

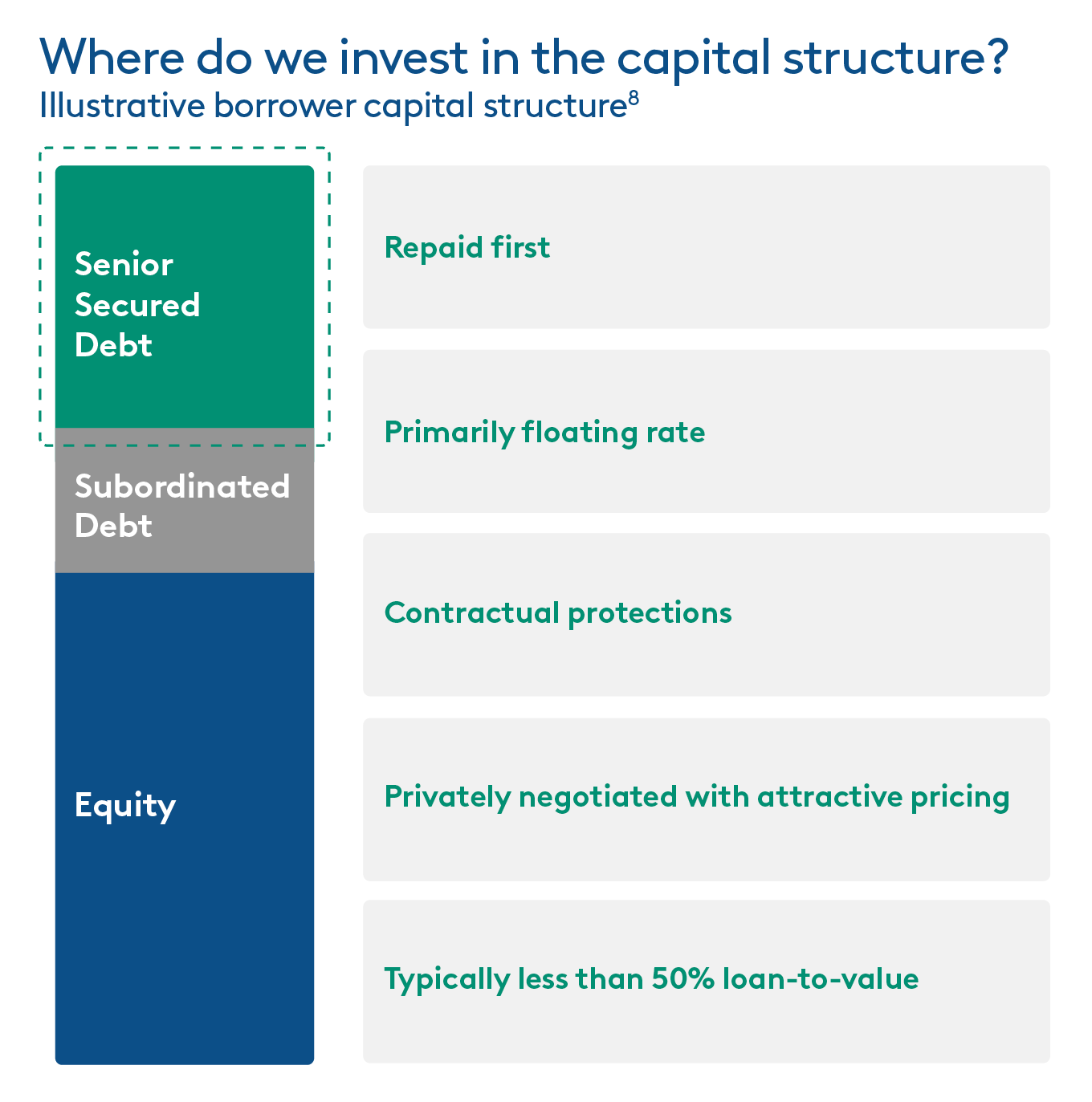

This is achieved through investing primarily in senior secured, floating rate loans to European companies.

These loans sit at the most protected part of the capital structure, typically with conservative loan to value ratios.

For informational purposes only. 1. EBITDA denotes earnings before interest, taxes, depreciation and amortization. 2. Automatic reinvestment for accumulating share classes. 3. For illustrative purposes only, and not meant to represent the actual capital structures of the Fund’s future investments.

Our investment focus is on non-cyclical, cash generative and well-managed businesses based in Northern and Western Europe.

They are in diverse sectors such as healthcare, technology, telecoms, financial services and business services, and are usually backed by high quality private equity sponsors.

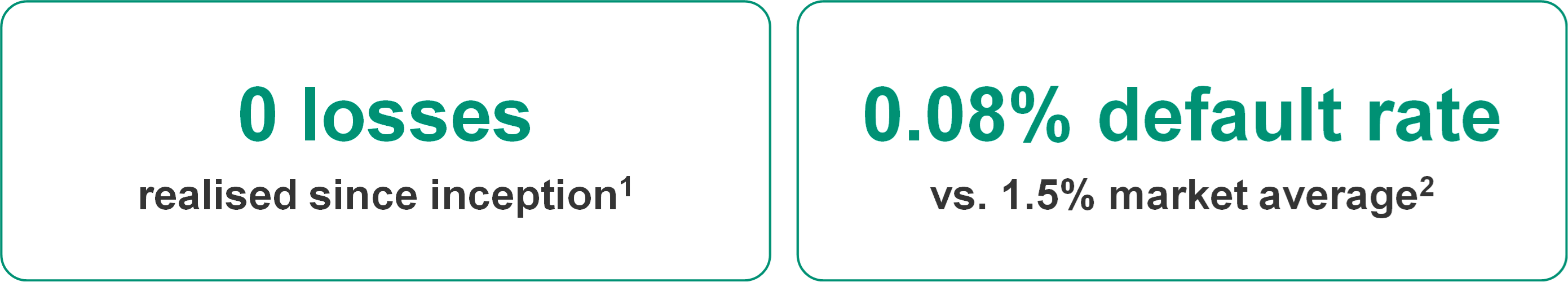

The results speak clearly. Since inception, CVC’s European Direct Lending platform has delivered consistent income, with zero realised losses and an annualised default rate of just 0.08%, far below the market average (Morningstar European Leveraged Loan Index).

For informational purposes only. All information as of 30 June 2025 unless otherwise noted. 1. Inception date is July 2014. 2. CVC annualised default rate since inception is 0.08% and is calculated based on payment defaults and restructured investments on the European Direct Lending platform. Market average default rate is the Morningstar European Leverage Loan Index (Morningstar ELLI).

CVC-CRED enables investors to capture Europe’s structural opportunities through a portfolio built for resilient performance, strong downside protection and steady returns.

What This Means for Investors

CVC-CRED combines premier access to Europe’s private credit market, where structurally wider spreads create compelling yield opportunities, with the strength of the CVC Network and the discipline of a proven investment process.

Our scale and deep local presence provide enhanced access to sponsors, companies, and sectors across the continent.

Strong access to deal flow through our origination platform allows us to remain highly selective in the proprietary investments we pursue. This aims to protect capital, while delivering consistent returns.

And with its evergreen structure, CVC-CRED aims to offer eligible investors not only flexibility and risk-adjusted returns, but also the potential for long-term wealth creation.

1 Why European Private Credit Belongs In Your Portfolio | CVC