Infrastructure's Edge

While private infrastructure appeals for its downside protection in times of volatility and potential for upside longer term, disciplined value creation, proactive exit management and expertise in building effective portfolio diversification increasingly define investment success.

Key Takeaways

-

Policy uncertainty and escalating geopolitical tensions have clouded the macro picture, prompting more cautiousness and selectivity, as investors evaluate allocation options to satisfy their portfolio objectives in a changing environment.

-

Grounded in real-asset fundamentals, private infrastructure offers downside protection amid volatility and the potential for strong risk-adjusted returns over the longer term.

-

GPs with clearly defined value creation capabilities, structured paths to liquidity realisation and diversified positioning will be best placed to deliver on the performance and distribution needs of investors in private infrastructure.

Striking the balance

Policy-driven uncertainty has marked 2025 like no year in recent memory. Against this macro backdrop, investors are exercising greater capital restraint. They want clearer visibility on the macro outlook and have dialled in on distributions as a central priority in portfolio planning.

In this environment, asset allocation, long recognised as the primary driver of long-term performance, has become more nuanced. Decisions now hinge on individual investment objectives, time horizons and current portfolio exposures.

Despite more cautious pacing, LPs continue to view private infrastructure as a core allocation. In polling conducted shortly after the announcement of U.S. tariffs, 91% planned to either hold steady (71%) or increase (20%) their allocations in 2025.1

Ultimately, investors face a delicate balancing act: Preserving short-term optionality while ensuring long-term exposure to opportunity. Caution is understandable, but prolonged delays to allocation decisions could prove costly. Although timing will remain crucial, having a clear strategic rationale and focused approach to implementation in private infrastructure may prove more important to long-term investment success.

Real assets, real returns

Many investors will be familiar with the common arguments that favour adding private infrastructure to an institutional portfolio. For performance drivers, these include the potential to earn higher returns through operational alpha together with illiquidity and complexity risk premia.

For downside protection, typical infrastructure assets are non-cyclical, benefitting from inelastic demand for essential services. In addition, revenues, which are often contracted on a long-term, price-indexed basis, help to sustain stable cash flows while mitigating against inflation risk that erodes real returns.

Core and Core-Plus strategies, for instance, typically deliver operating yields of around 5% per year, fortifying the stability of distributions.

Proven performance

The key question is whether these arguments stack up against past performance. Our analysis shows they have. Over 2007 to 2024, private infrastructure delivered significantly stronger risk-adjusted performance than the wider private capital market, global equities and global bonds (Exhibit 1).

Exhibit 1

Sources: Preqin, Bloomberg, CVC. Preqin Private Infrastructure Index (excl. Infrastructure Debt), Preqin Private Capital Index, MSCI World TR Index, Bloomberg Global Aggregate (Hedged to USD) Index. All indices are in USD. Annualised returns and volatility are calculated using quarterly return series from March 2007 to December 2024. Calculations for the annualised volatility of private infrastructure and private equity use de-smoothed quarterly returns adjusted for auto-correlations. Sharpe ratios are calculated based on SOFR rate post-2018 and Libor rate pre-2018. Annualised returns during high inflation regime are calculated using quarterly returns over 2022 to 2023.

Digging deeper into the details, we highlight four key insights that underscore the distinctive strengths of private infrastructure:

- Resilience in downturns – Across three major market shocks (2008, 2020, and 2022–23), private infrastructure demonstrated strong risk-adjusted performance. This resilience points to the inherent downside protection embedded within the asset class.

- Fundamental strength – With a Sharpe ratio of 1.0, double that of the broader private capital market (0.5), private infrastructure’s performance reflects not only its private market dynamics but also the underlying strength of real-asset fundamentals.

- Inflation protection – Despite lower overall volatility in global bonds, private infrastructure offered superior protection during the post-COVID inflation surge, delivering annualised returns of 10.5% compared to -2.5% for global bonds.

- Diversification benefits – Thanks to its low correlation with mainstream public markets, private infrastructure acts as a powerful portfolio diversifier, helping to mitigate the impact of correlation spikes.

Anchored for growth

In addition to enhancing portfolio durability in times of uncertainty, the long-term strategic case for allocating to private infrastructure is equally compelling. Megatrends in digitalisation and decarbonisation are projected to bring forth powerful, secular tailwinds to drive lasting investment opportunities ahead.

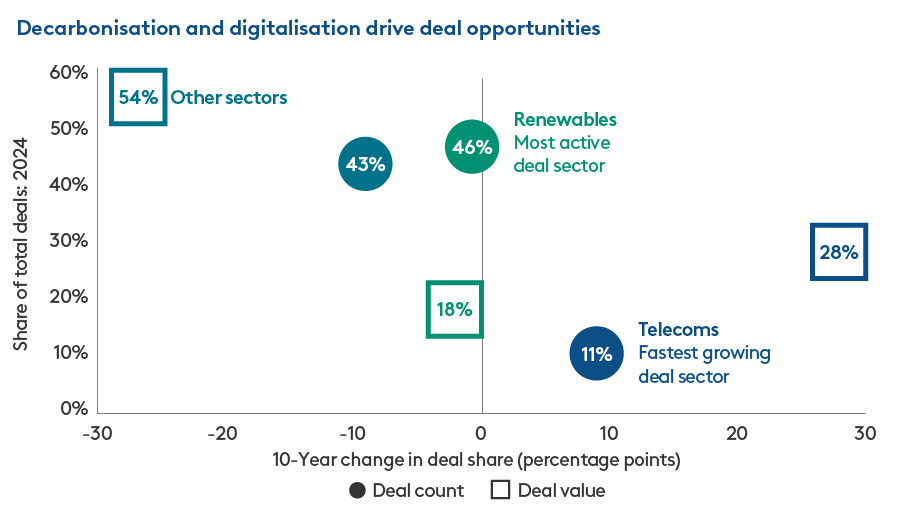

Exhibit 2

Sources: Preqin, CVC. As of 30 June 2025. Analysis includes Core, Core-Plus and Value-Add transactions over 2015-2024.

The scale of capital deployment required spans a vast opportunity set, including data centres, fibre, cloud platforms, power generation, transmission, storage and other enabling assets and technologies. Even now, the growing interest in these assets has made renewables and telecommunications two of the most in-demand areas of the private infrastructure deal market (Exhibit 2).

Beyond these key growth sectors, infrastructure assets in staple industries – waste and water management, district cooling and heating, transportation and others – are now, and will remain, core investment arenas. Though traditional, they are no less complex and no less rewarding, particularly for highly skilled GPs equipped with expertise in value creation.

Private capital: More than money

We are still in the early stages of the structural shifts driven by these macro trends, and private capital will play a vital role in providing essential financing. At a time when many national governments are facing tight budgetary constraints, a large and growing funding gap is already intensifying demand for private capital.

In total, the infrastructure funding gap is forecast to grow to $15 trillion by 2040.2 Private capital’s contribution, however, will not be limited to financing this shortfall. Sponsors can bring invaluable expertise, innovation and best-in-class operational management to drive cost discipline and efficiency enhancements, benefitting both service users and taxpayers.

Maximise value with a mid-market Focus

Successful allocation in private infrastructure hinges on discerning manager selection, with a clear understanding of their investment focus and approach to value creation. In this respect, mid-market strategies, which are well-known for their nimbleness and agility, can present attractive advantages.

Roughly 90% of global infrastructure deal flow occurs in the mid-market,3 which offers greater access to proprietary and bilateral transactions, lower entry multiples and a greater array of value-enhancement levers. In addition, mid-market assets are often suitable for add-on acquisitions, greenfield expansion and operational improvement, creating multiple paths to upside.

Europe: Epicentre of opportunity

Top-tier managers combine a disciplined investment approach with robust resources. To this end, having a global footprint and strong local presence, paired with deep sector expertise, are vital for sourcing and executing deals, especially in the more fragmented mid-market.

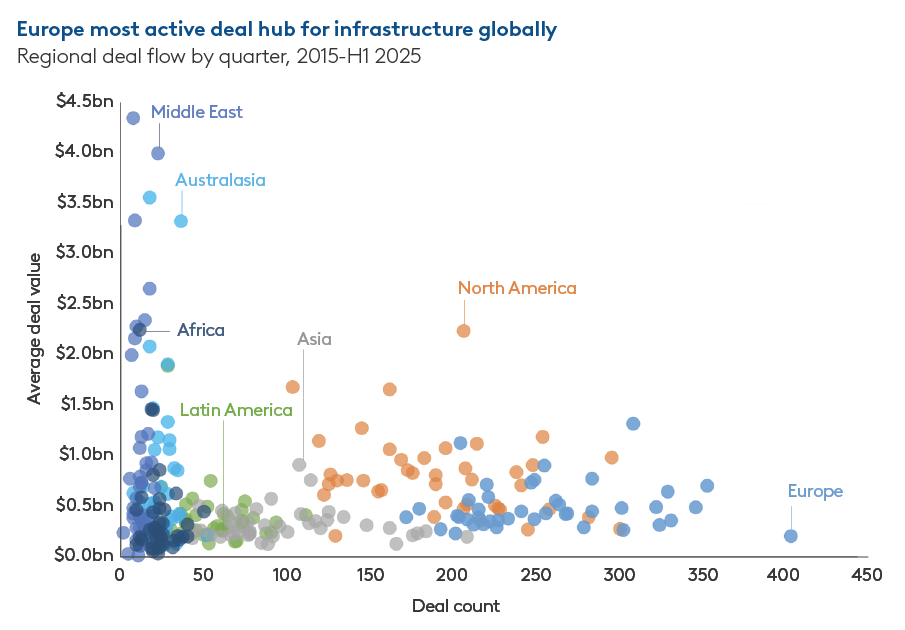

In terms of regions, Europe occupies centre stage when it comes to infrastructure opportunities. In Europe, the demand for private capital is acute, both for upgrading aging infrastructure and financing the digital and net-zero buildouts. Current demand for capital combines with strong regulatory and legal frameworks as well as a clear policy direction that make the region an ideal investment destination.

Europe already leads as the most active private infrastructure deal market globally (Exhibit 3), and several factors could extend this lead. Chief among them is heightened policy uncertainty, which may see more investors redirect capital toward Europe at a time when many are seeking to increase non-U.S. exposures.

Exhibit 3

Sources: Preqin, CVC. As of 30 June 2025.

Locating liquidity

Today, institutional investors are placing a higher importance on DPI as they evaluate private infrastructure strategies, following a general slowdown in private markets distribution activity.

Distribution expectations vary by strategy. Core and Core-Plus typically exhibit low to moderate risk/return profiles. By targeting operational, income-producing assets, they tend to deliver higher liquidity early in the investment life cycle. As a result, their DPI profiles are well-suited to income-focused investors, such as pension funds.

Value-Add strategies rely more on capital appreciation for return generation and thus have a moderately higher risk/return profile with DPI loaded at the back-end.

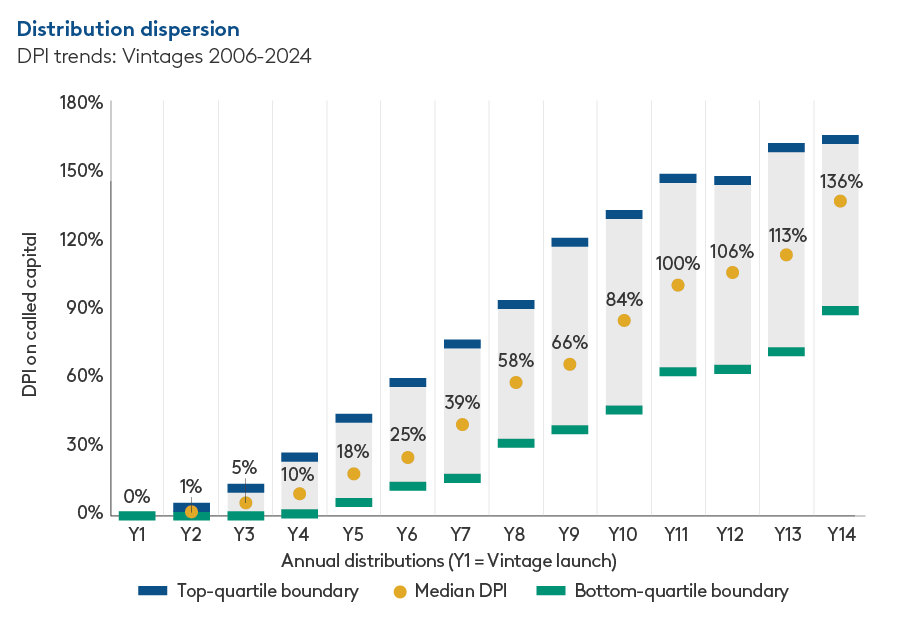

Strategy selection will depend on individual investment objectives, but manager selection is also critical. Historically, distribution dispersion has been high across the private infrastructure market – a factor that underscores the importance of partnering with experienced GPs who have proven track records across economic cycles (Exhibit 4).

Realising liquidity in private infrastructure is not a one-size-fits-all endeavour. It demands a holistic approach that combines asset-level optimisation, macro awareness, thoughtful portfolio construction, effective diversification, legal preparation and alignment with investor needs.

The most successful liquidity strategies are those that are proactively designed from the start, not afterthoughts at the end of an investment life cycle.

By focusing on asset maturity, exit optionality, timing, and transparency, managers can unlock value efficiently and consistently – delivering both financial performance and investor satisfaction.

Equally important is a strategic focus on assets with true infrastructure characteristics (i.e., hard assets, long-term contracts, essential services and high barriers to entry), which reinforces recurring cash flow to strengthen DPI outcomes.

Exhibit 4

Sources: Preqin, CVC. As of 30 June 2025. Chart shows DPI trends by vintage year (2006–2024) for private infrastructure funds, based on the Preqin Infrastructure - All (28) benchmark. The median DPI is calculated as the median (per calendar year) of vintage-level medians, shown as a percentage of called capital. Median values for the top- and bottom-quartile boundaries are also shown by calendar year. Data reflect year-end figures.

Bottom line

Private infrastructure stands at the intersection of resilience and opportunity in an increasingly uncertain investment landscape. While policy-driven volatility in 2025 has prompted investors to adopt more measured capital pacing, the long-term fundamentals of the asset class remain compelling.

With proven downside protection, inflation resilience and diversification benefits, infrastructure continues to earn its place as a core allocation.

As secular trends in digitalisation and decarbonisation accelerate, the mid-market, especially in Europe, offers fertile ground for differentiated returns. GPs who combine strategic clarity with proactive execution will be best positioned to capture value and generate durable, real returns for their clients across cycles.

Important Notice to Recipients:

This confidential document (this “Confidential Document”) is being communicated to a limited number of sophisticated persons (each, a “Recipient”) by CVC, as defined below for information purposes only. THIS CONFIDENTIAL DOCUMENT IS NOT INTENDED TO FORM THE BASIS OF ANY INVESTMENT DECISION AND MAY NOT BE USED FOR AND DOES NOT CONSTITUTE AN OFFER TO SELL, OR A SOLICITATION OF ANY OFFER TO SUBSCRIBE FOR OR PURCHASE ANY INTERESTS OR TO ENGAGE IN ANY OTHER TRANSACTION. Nothing contained herein shall be deemed to be binding against, or to create any obligations or commitment on the part of, the addressee nor any of CVC Capital Partners plc, Clear Vision Capital Fund SICAV-FIS S.A, each of their respective successors or assigns and any form of entity which is controlled by, or under common control with CVC Capital Partners plc or Clear Vision Capital Fund SICAV-FIS S.A. (from time to time the “CVC Entities“ or “CVC” and each a “CVC Entity”). For the purpose of the foregoing definitions, control includes the power to (directly or indirectly and whether alone or with others) appoint or remove a majority of an entity’s directors or its general partner, manager, adviser, trustee, founder, guardian, beneficiary or other management officeholder) and controlled and controlling shall be interpreted accordingly. No CVC Entity undertakes to provide the addressee with access to any additional information or to update this Confidential Document or to correct any inaccuracies herein which may become apparent. This Confidential Document is not intended for distribution, and shall not be distributed, in any jurisdiction where such distribution would violate applicable securities laws.

Certain information contained herein (including certain forward-looking statements, financial, economic and market information) has been obtained from a number of published and non-published sources prepared by other parties and companies, which may not have been verified and in certain cases has not been updated through the date hereof. While such information from other parties and companies is believed to be reliable for the purpose used herein, no member of CVC, any of their respective affiliates or any of their respective directors, officers, employees, members, partners or shareholders assumes any responsibility for the accuracy or completeness of such information. Certain economic, financial, market and other data and statistics produced by governmental agencies or other sources set forth herein or upon which the CVC’ analysis and decisions rely may prove inaccurate.

Nothing contained herein shall constitute any assurance, representation or warranty and no responsibility or liability is accepted by CVC or its affiliates as to the accuracy or completeness of any information supplied herein or any assumptions on which such information is based. Further, this Confidential Document reflects only the views of CVC with respect to private equity markets and other market participants may hold different views or opinions. Accordingly, each Recipient should conduct their own independent due diligence and not rely on any statement or opinion offered herein.

In addition, no responsibility or liability or duty of care is or will be accepted by CVC or its respective affiliates, advisers, directors, employees or agents for updating this Confidential Document (or any additional information), or providing any additional information to you. Accordingly, to the fullest extent possible and subject to applicable law, none of CVC or its affiliates and their respective shareholders, advisers, agents, directors, officers, partners, members and employees shall be liable (save in the case of fraud) for any loss (whether direct, indirect or consequential), damage, cost or expense suffered or incurred by any person as a result of relying on any statement in, or omission from, this Confidential Document.

1 Campbell Lutyens. Market Pulse April 2025. Survey covers 150 LPs in 23 countries polled over 4-12 April 2025.

2 Global Infrastructure Outlook. A G20 Initiative. https://outlook.gihub.org. Retrieved 30 June 2025.

3 CVC DIF analysis of Preqin data over 10 years to 17 July 2025. Mid-Market includes deals valued <€1bn.